Are you considering a personal loan to consolidate debt, renovate your home, or fund a significant purchase? Navigating the world of loans can be overwhelming, but understanding how to use a personal loan calculator effectively is the first step towards making a smart financial decision. A personal loan calculator is an invaluable tool that allows you to quickly estimate your monthly payments, total interest paid, and overall loan cost based on various factors like the loan amount, interest rate, and loan term. Mastering this tool empowers you to compare loan offers, understand the true cost of borrowing, and ultimately, choose the most suitable loan for your financial needs.

This guide will equip you with the knowledge to use a personal loan calculator accurately and efficiently. We’ll delve into the key inputs required, explain how the calculations work, and show you how to interpret the results to make informed choices. Learn how to effectively compare different loan offers side-by-side, identify potential hidden fees, and avoid common pitfalls. By the end of this article, you’ll be confident in your ability to leverage a personal loan calculator to secure the best possible personal loan terms and make sound financial decisions.

What a Personal Loan Calculator Actually Shows

A personal loan calculator is a useful tool for estimating the cost of a personal loan before you apply. It provides a preliminary overview of potential loan terms and their associated financial implications, helping you make an informed decision.

Key information typically displayed by a personal loan calculator includes the monthly payment amount. This is calculated based on the loan amount, interest rate, and loan term (repayment period). It gives you a clear picture of your potential monthly financial commitment.

Calculators also show the total interest paid over the life of the loan. This is a crucial figure as it represents the additional cost beyond the principal loan amount. Understanding this helps you compare loans and make choices that minimize your overall borrowing expense.

The total repayment amount, which is the sum of the principal loan amount and the total interest, is also usually displayed. This figure provides a comprehensive picture of the complete cost of borrowing.

Some advanced calculators may even offer a comparison feature, allowing you to input different loan terms simultaneously to compare the associated costs of various loan options. This allows for side-by-side comparison, facilitating a more effective decision making process.

It’s important to remember that the results provided by a personal loan calculator are estimates. The actual terms you receive from a lender may differ slightly due to factors like your credit score and the lender’s specific policies. Nevertheless, the calculator provides a valuable starting point for exploring your borrowing options.

Inputs You Need to Get an Accurate Estimate

To obtain a truly accurate estimate using a personal loan calculator, you need to provide several key pieces of information. The more precise your inputs, the more reliable your results will be.

First and foremost, you’ll need to specify the loan amount you’re seeking. This is the principal sum you intend to borrow. Be realistic in your assessment of your needs and borrowing capacity.

Next, you must input the interest rate. This is typically expressed as an annual percentage rate (APR). While a personal loan calculator might offer an estimate based on average rates, it’s best to use the specific rate offered by your lender to guarantee accuracy. Remember, interest rates fluctuate based on various factors including credit score and market conditions.

The loan term, or repayment period, is another crucial input. This is expressed in months or years and significantly impacts your monthly payment and total interest paid. A longer loan term will result in lower monthly payments but a higher overall cost due to accumulated interest. Conversely, a shorter loan term will lead to higher monthly payments but less total interest paid.

Finally, some calculators might require additional information such as fees associated with the loan. These could include origination fees, prepayment penalties, or other charges. Including these fees in your calculation gives you a comprehensive understanding of the actual cost of the loan.

By providing these essential inputs, you can leverage the personal loan calculator effectively and obtain a trustworthy estimate that helps you make informed financial decisions.

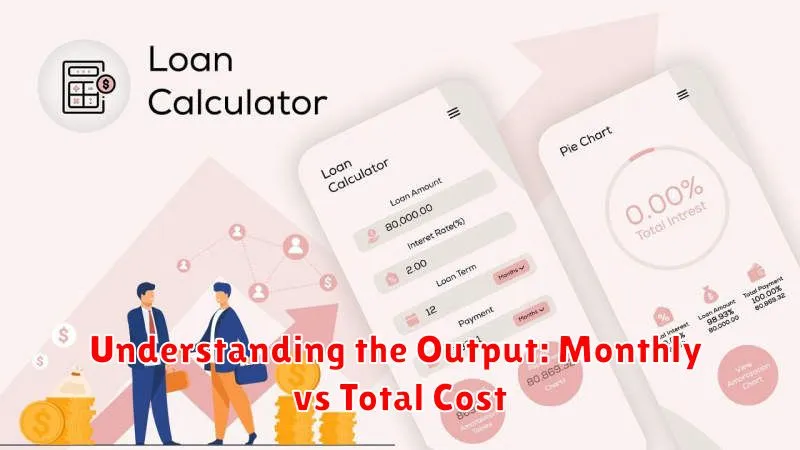

Understanding the Output: Monthly vs Total Cost

A personal loan calculator provides two crucial figures: the monthly payment and the total cost of the loan. Understanding the difference between these two is key to making an informed borrowing decision.

The monthly payment represents the fixed amount you’ll pay each month over the loan’s term. This figure is calculated based on several factors, including the loan amount, interest rate, and loan term (length of the loan).

The total cost, on the other hand, represents the sum of all payments you’ll make over the entire loan period. It includes not only the principal amount borrowed but also the accumulated interest charged throughout the repayment period. This figure provides a clearer picture of the overall expense of borrowing.

Let’s illustrate with an example. Suppose a calculator shows a monthly payment of $300 and a total cost of $3,600 for a 12-month loan. This means you’ll pay $300 each month for a year, totaling $3,600. The difference between the total cost and the principal loan amount ($3,600 – principal) represents the total interest paid.

By carefully analyzing both the monthly payment and the total cost, you can assess the affordability and the overall financial implications of the loan. A lower monthly payment might seem appealing, but a higher total cost could indicate a longer loan term and increased interest payments. Conversely, a higher monthly payment might mean a shorter loan term and reduced total interest, but it could strain your monthly budget.

How Interest and Tenure Impact the Results

A personal loan calculator relies on two crucial inputs to determine your monthly payment and total repayment amount: the interest rate and the loan tenure (or repayment period).

The interest rate is the cost of borrowing money. A higher interest rate means you’ll pay more in interest over the life of the loan. This directly impacts your monthly payment and the total amount you repay. For example, a loan with a 10% interest rate will cost significantly more than a loan with a 5% interest rate, even if the loan amount and tenure are the same.

The loan tenure, typically expressed in months or years, represents the time you have to repay the loan. A longer tenure results in lower monthly payments because the loan is spread over a longer period. However, the total interest paid will be higher because you’re paying interest for a longer duration. Conversely, a shorter tenure leads to higher monthly payments but lower overall interest charges.

Therefore, understanding the interplay between interest rate and tenure is vital for making informed decisions. A personal loan calculator allows you to experiment with different interest rates and tenures to see how they affect your monthly payments and the total cost of borrowing. This helps you choose a loan option that best aligns with your financial capabilities and long-term goals. Careful consideration of these factors will significantly impact the overall affordability and cost-effectiveness of your personal loan.

Common Mistakes When Using Loan Calculators

One common mistake is inputting incorrect data. Double-check all figures, including the loan amount, interest rate (expressed as a decimal, not a percentage), and loan term (in years or months). Even a small error can significantly alter the calculated results.

Another frequent error is misunderstanding the displayed figures. Loan calculators typically show the monthly payment, total interest paid, and total repayment amount. It’s crucial to understand the difference between these figures and not to confuse them. For instance, the monthly payment doesn’t represent the total cost of the loan.

Many users fail to account for additional fees. Loan calculators often only consider the principal and interest. However, some loans involve closing costs, origination fees, or prepayment penalties. These fees can substantially increase the overall cost and should be factored into your calculations separately or, if the calculator allows, included in the initial input.

Ignoring the impact of different interest rates is also a common mistake. Even minor variations in interest rates can lead to substantial differences in total interest paid over the loan’s lifespan. It’s advisable to experiment with different interest rates to gauge their impact on your payments and total cost.

Finally, many overlook the importance of comparing multiple loan offers. Using a loan calculator for each offer allows for a clear comparison between lenders and their terms, enabling you to choose the option that best suits your financial circumstances. Don’t rely on a single calculator or lender’s presented information.

Why It’s Only an Estimate, Not a Guarantee

A personal loan calculator provides a valuable estimate of your potential loan terms, but it’s crucial to understand that it’s not a guarantee of what you’ll actually receive.

The calculator relies on the information you input. Inaccuracies in this data, whether intentional or unintentional, will directly impact the results. For example, a slight miscalculation of your income or credit score can significantly alter the estimated interest rate and monthly payment.

Furthermore, the calculations are based on current lending standards and available rates at the time of use. Lending institutions frequently adjust their criteria and interest rates, meaning the estimate may become outdated quickly. A lender’s internal assessment of your creditworthiness, including a detailed review of your credit report, might also lead to a different outcome than what the calculator suggests.

Finally, many calculators simplify complex financial models. They may not account for all fees or additional charges associated with the loan, such as origination fees or prepayment penalties. These hidden costs can affect the total cost of borrowing, which the calculator’s simplified estimate may not fully reflect.

Therefore, while a personal loan calculator is a useful planning tool, always remember that it provides only an approximation. To obtain the definitive terms of a personal loan, you must apply directly with a lender and undergo their formal application process.