Understanding the Annual Percentage Rate (APR) on your personal loan is crucial for making informed financial decisions. A low APR can save you significant money over the life of your loan, while a high APR can dramatically increase your total repayment cost. This comprehensive guide will equip you with the knowledge to decipher your loan’s APR, compare offers from different lenders, and ultimately secure the most favorable terms for your personal loan.

We’ll break down the components of APR, explaining how it differs from the interest rate and what other fees might be included. You’ll learn how to use this information to effectively compare personal loan offers from banks, credit unions, and online lenders. By the end of this article, you’ll be empowered to negotiate a better deal and avoid hidden costs, ensuring you get the best possible personal loan with a manageable APR.

What Is APR and Why It Matters

APR, or Annual Percentage Rate, is the annual rate charged for borrowing money, represented as a single percentage number. It’s a crucial factor in understanding the true cost of a personal loan.

Unlike the interest rate, which only reflects the base cost of borrowing, the APR encompasses all fees and charges associated with the loan. This includes things like origination fees, application fees, and any other charges levied by the lender. Therefore, the APR provides a more complete picture of your loan’s cost.

Understanding your APR is vital because it directly impacts your overall repayment amount. A higher APR means you’ll pay significantly more in interest over the life of the loan, leading to a larger total repayment. Conversely, a lower APR can save you substantial money.

Comparing APRs from different lenders is essential before accepting a personal loan. By focusing solely on the interest rate, you might overlook significant added fees, resulting in a less favorable deal. Always compare the full APR to make an informed financial decision.

In short, the APR is not just a number; it’s a critical metric that reflects the real cost of borrowing and should be a primary consideration when choosing a personal loan.

How APR Differs from Interest Rate

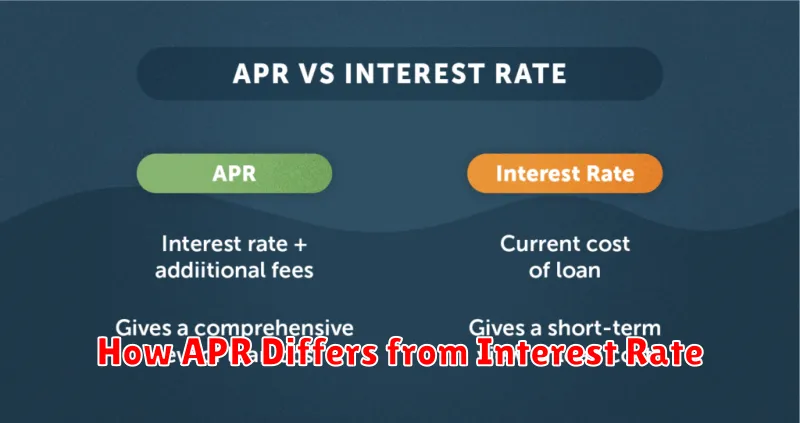

While the terms “Annual Percentage Rate” (APR) and “interest rate” are often used interchangeably, they represent distinct concepts in personal loan calculations. Understanding this difference is crucial for making informed borrowing decisions.

The interest rate is simply the cost of borrowing money, expressed as a percentage of the principal loan amount. It reflects the lender’s base charge for providing funds. This rate is typically stated as an annual figure. For example, a 5% interest rate means you pay 5% of your outstanding loan balance each year.

However, the APR provides a more comprehensive picture of the total cost of borrowing. Unlike the simple interest rate, the APR includes not only the interest but also all other fees and charges associated with the loan. This can encompass origination fees, application fees, prepayment penalties, and other associated costs.

Therefore, the APR is always higher than the interest rate unless there are no additional fees charged by the lender. It presents a true reflection of the actual annual cost of the loan, allowing for a more accurate comparison between different loan offers. A loan with a lower interest rate but higher fees could potentially have a higher APR than a loan with a slightly higher interest rate but lower fees.

By focusing solely on the interest rate, borrowers risk overlooking the significant impact of additional charges, leading to an inaccurate assessment of the loan’s overall cost. Using the APR as a benchmark for comparison ensures a fairer and more informed decision-making process when selecting a personal loan.

What Fees Are Included in the APR

The Annual Percentage Rate (APR) isn’t just your interest rate; it encompasses all the fees associated with your personal loan, expressed as a yearly percentage. Understanding what’s included is crucial for comparing loan offers effectively.

Typically, the APR incorporates interest charges, which are the cost of borrowing the money. However, it also includes various other fees, the specifics of which can vary between lenders and loan types. These can include:

- Origination fees: These are upfront charges levied by the lender for processing your loan application.

- Application fees: A fee charged for applying for the loan, regardless of approval.

- Prepayment penalties: Fees incurred if you pay off the loan early.

- Late payment fees: Penalties for missed or late payments.

- Administrative fees: Miscellaneous fees for administrative tasks related to your loan.

It’s essential to carefully review the loan agreement to see exactly which fees are factored into your APR. Don’t just focus on the advertised interest rate; the APR provides a more complete picture of the true cost of borrowing.

Some lenders may list fees separately, while others incorporate them into the APR. Therefore, it’s imperative to ask clarifying questions if anything is unclear. Comparing loans solely on the advertised interest rate can be misleading, as different fees can significantly alter the overall cost.

How to Compare APR Across Different Offers

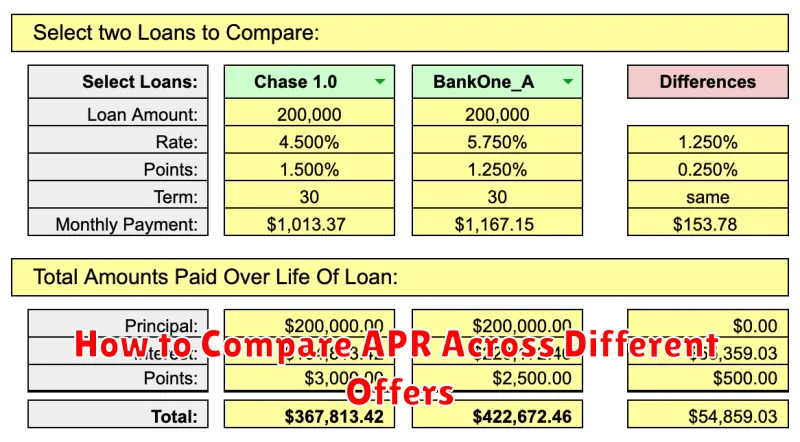

Comparing Annual Percentage Rates (APR) across different personal loan offers is crucial for securing the best possible deal. While a lower APR is generally preferable, a simple numerical comparison isn’t always sufficient. You need to consider the total cost of the loan, which encompasses the interest and any associated fees.

First, ensure you’re comparing apples to apples. Make sure all APRs quoted reflect the same loan term. A lower APR over a shorter term might ultimately cost more than a slightly higher APR spread over a longer repayment period. Carefully review the loan terms and conditions for each offer to understand the repayment schedule and any potential prepayment penalties.

Next, pay close attention to any additional fees associated with each loan. Origination fees, application fees, and late payment fees can significantly increase the overall cost of the loan. These fees are often not directly reflected in the APR, so factor them into your calculations to determine the true cost of borrowing. Use a loan calculator to model the total repayment amount including fees for each loan offer for a truly accurate comparison.

Finally, don’t solely focus on the APR. Consider other factors such as the loan amount, repayment flexibility, and the lender’s reputation and customer service. A slightly higher APR from a reputable lender with favorable terms might be a better choice than a lower APR from a less trustworthy source. A thorough comparison, considering all relevant factors, will empower you to make an informed decision that aligns with your financial goals.

Fixed vs Variable APR Explained

Understanding the Annual Percentage Rate (APR) on your personal loan is crucial for managing your finances effectively. A key aspect of this understanding involves differentiating between fixed and variable APRs.

A fixed APR remains constant throughout the entire loan term. This means your monthly payments will stay the same, providing predictable budgeting and financial planning. Knowing exactly how much you’ll pay each month eliminates uncertainty and allows for better long-term financial management. The fixed rate is set at the time you take out the loan and doesn’t fluctuate with market changes.

Conversely, a variable APR fluctuates based on an index rate, such as the prime rate or LIBOR. This means your monthly payments can change over the life of the loan. While a lower initial rate might be attractive, increases in the index rate will directly impact your monthly payment, potentially leading to higher total interest paid over the loan’s duration. The variable nature of the APR introduces an element of unpredictability into your financial planning.

The choice between a fixed and variable APR depends on your individual circumstances and risk tolerance. A fixed APR offers stability and predictability, while a variable APR might offer a lower initial rate but carries the risk of increased payments later.

Carefully consider your financial situation and long-term goals when deciding which type of APR is best suited for your needs. Understanding the differences between fixed and variable APRs empowers you to make informed decisions about your personal loan.

How to Use APR to Make Smart Borrowing Choices

Understanding the Annual Percentage Rate (APR) is crucial for making informed borrowing decisions. The APR represents the total cost of borrowing, encompassing not only the interest rate but also other fees and charges associated with the loan. By carefully comparing the APRs of different loan offers, you can identify the most cost-effective option.

When comparing loans, always focus on the APR rather than just the interest rate. A lower interest rate might seem attractive, but if it hides significant fees, the overall APR could be higher than a loan with a slightly higher interest rate and lower fees. This is why understanding the APR is so vital.

To make smart borrowing choices, thoroughly analyze the APR of each loan offer. Lower APRs generally translate to lower overall borrowing costs. Consider factors like loan terms, repayment schedules, and any associated fees to get a complete picture of the total cost before committing to a loan.

Don’t hesitate to shop around and compare offers from multiple lenders. This will allow you to identify the lender with the most favorable APR, saving you money in the long run. Remember, a seemingly small difference in APR can accumulate to significant savings over the loan’s lifetime.

In addition to comparing APRs, it’s essential to understand the loan terms. A shorter loan term might result in higher monthly payments but lower overall interest paid, whereas a longer term will have lower monthly payments but a higher total interest cost. Finding the right balance that suits your financial situation is key.