Understanding student loan interest capitalization is crucial for borrowers seeking to manage their debt effectively. This often-overlooked aspect of loan repayment can significantly impact the total amount you ultimately repay. Capitalization, simply put, is the process where accrued interest is added to your principal loan balance, increasing the amount you owe and ultimately leading to higher payments. This article will illuminate the intricacies of student loan interest capitalization, exploring how it works, when it occurs, and strategies to minimize its effect on your student loan debt.

Failing to grasp the implications of interest capitalization can result in paying substantially more over the life of your loans. This guide will equip you with the knowledge to navigate this complex aspect of student loan repayment. We’ll delve into the various scenarios where capitalization takes place, explain the different types of federal student loans and how capitalization affects each, and provide actionable steps to potentially mitigate the impact of capitalization on your student loan debt. Ultimately, understanding student loan interest capitalization is a key component of responsible student loan management.

What Is Interest Capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to the principal balance of a loan. In simpler terms, it means that instead of paying interest separately, the unpaid interest is added to the original loan amount, increasing the total amount you owe.

This process increases the principal balance, meaning that future interest calculations will be based on a larger amount. As a result, borrowers will end up paying more in interest over the life of the loan because interest will accrue on a higher principal amount.

While seemingly a technical detail, understanding interest capitalization is crucial for managing student loan debt. The implications can significantly impact the overall cost of your education and the repayment schedule.

It’s important to note that interest capitalization typically occurs during periods when interest is accruing but payments are not being made, such as while a student is still in school or during a deferment or forbearance period.

The impact of interest capitalization can be substantial, particularly over several years of deferment or forbearance. This is why understanding your loan terms and the conditions under which capitalization may occur is critical for effective student loan management.

When It Happens and Why It Matters

Interest capitalization occurs when your unpaid interest on a student loan is added to your principal balance. This means the interest becomes part of the loan’s total amount you owe, and you’ll start accruing interest on that added amount.

This typically happens during periods of deferment or forbearance, when you’re temporarily not required to make payments on your student loan. During these periods, interest continues to accrue but isn’t paid, leading to capitalization when the deferment or forbearance ends. It can also occur after graduation if you have a grace period before repayment begins.

Understanding when capitalization happens is crucial because it significantly impacts the total cost of your loan. The more frequently your interest capitalizes, the faster your loan balance grows, leading to higher overall interest payments and a longer repayment period. This results in a higher total amount repaid over the life of the loan.

The impact of capitalization is particularly relevant for borrowers with substantial interest or those who experience multiple periods of deferment or forbearance. This compounding effect can substantially increase the total cost of borrowing, making it vital to minimize these periods whenever possible and to understand the terms and conditions of your student loans.

How Capitalization Increases Total Repayment

Capitalization, in the context of student loans, is the process of adding unpaid interest to your principal loan balance. This means that the interest, which would normally be paid separately, becomes part of the new principal amount you owe.

The impact of this seemingly simple process is significant. Because the interest is now part of the principal, you’ll start accruing interest on that added interest during the next payment period. This creates a compounding effect, leading to a substantially larger total repayment amount over the life of the loan.

Let’s illustrate with an example: Imagine you have a $10,000 loan with a 5% interest rate. If you don’t make payments for a year, you will accrue $500 in interest. After capitalization, your principal will become $10,500. Future interest calculations will be based on this higher amount, resulting in even more interest accumulating each year, unlike if you had made payments covering the interest.

Therefore, the longer the period before repayment begins, or the longer interest is allowed to capitalize, the more significant the increase in the total repayment amount will be. This is why understanding capitalization and its implications is crucial for effective student loan management. It directly impacts the total cost of your education.

It’s also important to note that capitalization can occur at different times depending on your loan terms. Some loans might capitalize unpaid interest annually, while others might do so after a specific grace period or when payments are missed. Careful review of your loan documents is paramount to understanding when and how capitalization affects your debt.

Federal vs Private Loan Capitalization Rules

Understanding the differences in capitalization rules between federal and private student loans is crucial for effective loan management. These rules dictate when and how unpaid interest is added to your principal loan balance, significantly impacting your total repayment amount and overall cost.

For federal student loans, capitalization typically occurs only under specific circumstances. This might happen after you leave school and enter a grace period before beginning repayment, if you defer or forbear your loans, or if you consolidate your federal loans. The key difference is that the government often provides options to avoid capitalization through specific repayment plans or other programs. Careful review of your loan servicer’s information is recommended.

In contrast, private student loans generally have stricter and less flexible capitalization rules. Many private lenders automatically capitalize unpaid interest at regular intervals, such as monthly or annually. This means interest accrues and is added to your principal, resulting in a higher loan balance and increased interest charges over the life of the loan. Private loan agreements should be thoroughly reviewed for specifics concerning capitalization policies and repayment schedules. The terms vary widely between lenders.

The impact of capitalization on both federal and private loans is substantial. The earlier interest is capitalized, the more it compounds over time, leading to a potentially much larger total repayment amount. Borrowers should strive to make timely payments to minimize the negative effects of capitalization and keep their loan costs as low as possible. Understanding how capitalization works for your specific loan type is a critical factor in financial planning after college.

How to Minimize or Avoid Capitalization

Capitalization of student loan interest, the addition of accrued interest to your principal loan balance, significantly increases the total amount you’ll eventually repay. Understanding how this process works is crucial to minimizing its impact.

One of the most effective ways to minimize capitalization is to make on-time payments throughout your repayment period. Consistent payments prevent interest from accumulating and subsequently being added to your principal. Even small, regular payments can make a substantial difference over time.

Another strategy is to explore income-driven repayment (IDR) plans. These plans adjust your monthly payments based on your income and family size, making them more manageable. While IDR plans may extend your repayment period, they often reduce your monthly payments, potentially freeing up funds to pay down your principal and thus reducing the amount subject to capitalization.

Consider loan consolidation as a potential solution. Consolidating multiple loans into a single loan can simplify repayment and, depending on the terms of your new loan, may offer a lower interest rate, leading to less interest capitalization over the loan’s lifetime. However, it’s important to carefully compare the terms of the new loan before making this decision.

Finally, paying off your loans early is the most direct way to prevent further capitalization. Any extra funds you can allocate to your student loan debt will reduce the interest that accrues and minimizes the overall amount subject to capitalization. Even small extra payments made consistently can lead to significant savings in the long run.

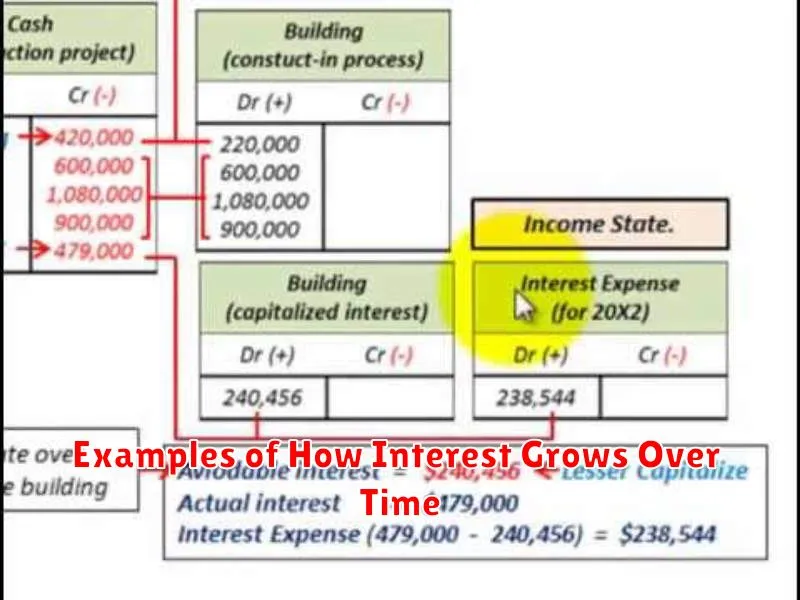

Examples of How Interest Grows Over Time

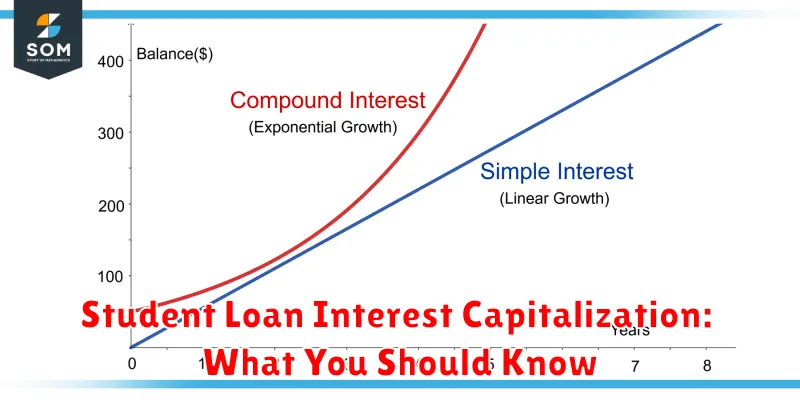

Understanding how interest capitalization works requires grasping the concept of compound interest. This means that interest is not only calculated on the principal loan amount but also on any accumulated interest. Over time, this snowball effect can significantly increase the total amount you owe.

Let’s illustrate with a simple example. Suppose you have a $10,000 student loan with a 5% annual interest rate. If interest is capitalized annually, at the end of the first year, you’ll owe $500 in interest ($10,000 x 0.05). This $500 is added to your principal, making your new principal $10,500. In the second year, interest is calculated on this higher amount, resulting in $525 ($10,500 x 0.05) in interest. This continues each year, with the interest accumulating on an increasingly larger principal balance.

Another example demonstrates the effect of different capitalization periods. Consider the same $10,000 loan at 5% interest. If interest is capitalized monthly, the calculations are more frequent. While the individual monthly interest accrual is smaller, the more frequent compounding leads to a larger total interest paid over the loan term compared to annual capitalization. The difference might seem minimal initially, but over several years, the accumulated interest can be substantial.

Finally, consider the impact of a higher interest rate. If the interest rate on the $10,000 loan were 7% instead of 5%, the amount of interest capitalized each period would increase proportionally. This dramatically accelerates the growth of the principal balance and the overall cost of the loan. The longer the repayment period, the more pronounced this effect becomes.