Securing a business loan can be a pivotal moment for any entrepreneur, offering the capital needed for expansion, equipment upgrades, or navigating challenging economic periods. However, timing is crucial. Applying too early can result in rejection due to insufficient business history or inadequate financial planning, while applying too late might mean missing crucial opportunities. Understanding when the optimal time is to pursue a business loan is essential for maximizing your chances of approval and achieving your financial goals. This article explores the key factors to consider when determining the right time to apply for a small business loan or a larger commercial loan.

This guide will help you assess your financial readiness, analyze your business performance, and identify the most opportune moment to seek funding. We’ll cover critical aspects like establishing a strong credit score, building a compelling business plan, demonstrating consistent revenue streams, and understanding the different types of loans available. Learn how to avoid common pitfalls and leverage your financial strength to secure the funding you need to propel your business towards success. By understanding the timing, you can significantly increase your likelihood of a favorable outcome and navigate the loan application process with confidence.

Assessing Your Business’s Financial Health

Before applying for a business loan, it’s crucial to thoroughly assess your business’s financial health. Lenders will meticulously examine your financial statements to determine your creditworthiness and the likelihood of loan repayment. A strong financial position significantly increases your chances of loan approval and securing favorable terms.

Key financial indicators lenders scrutinize include your revenue, expenses, profitability, and cash flow. Revenue represents your total sales, illustrating the size and strength of your business. Expenses encompass all costs associated with operating your business, from rent and salaries to supplies and marketing. Profitability, typically measured by net income or profit margin, showcases your ability to generate profit after covering all expenses. Cash flow, the movement of money in and out of your business, reflects your ability to meet your financial obligations promptly.

Analyzing your balance sheet, income statement, and cash flow statement provides a comprehensive overview of your financial standing. The balance sheet presents a snapshot of your assets, liabilities, and equity at a specific point in time. The income statement summarizes your revenues and expenses over a period, revealing your profitability. The cash flow statement tracks the flow of cash within your business, highlighting sources and uses of funds.

Understanding your debt-to-equity ratio, a key metric reflecting your reliance on debt financing, is also essential. A high ratio might signal increased financial risk to lenders. Additionally, credit scores for both your business and personally play a vital role in loan applications. A strong credit history demonstrates responsible financial management.

By meticulously reviewing your financial records and understanding these key indicators, you can accurately assess your business’s readiness for a loan application. This proactive assessment not only enhances your chances of loan approval but also empowers you to negotiate favorable loan terms with lenders.

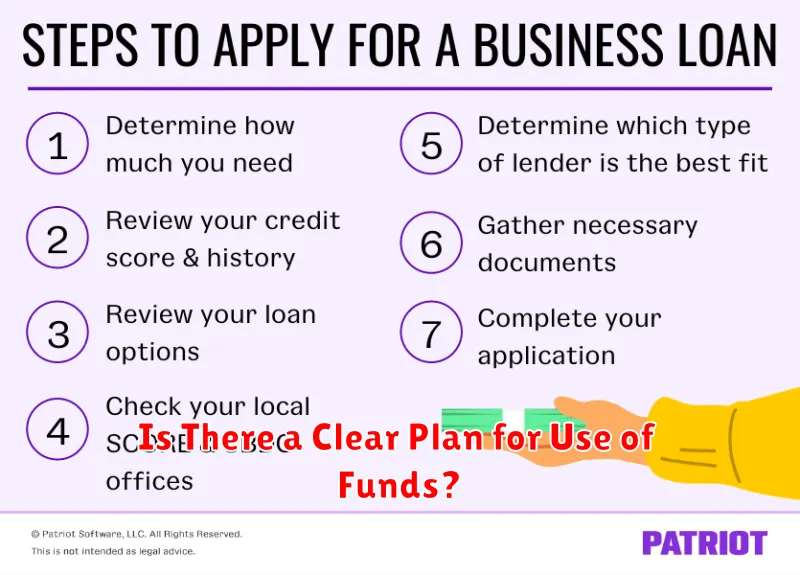

Is There a Clear Plan for Use of Funds?

Before applying for a business loan, it’s crucial to have a meticulously detailed plan outlining how the loan funds will be utilized. Lenders want to see clear evidence of financial responsibility and a demonstrable understanding of how the loan will contribute to the business’s growth and profitability. A vague or poorly defined plan raises significant red flags, suggesting a lack of preparedness and potentially increasing the risk of loan default.

Your plan should go beyond simply stating the intended purpose. It needs to include specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, instead of saying “to improve marketing,” your plan should specify “to increase brand awareness by 20% within six months through a targeted social media campaign and website redesign, using $10,000 of the loan funds.” This level of detail demonstrates foresight and commitment.

Furthermore, the plan must include a realistic budget detailing how the loan funds will be allocated to each specific initiative. This budget should align with the overall financial projections and demonstrate how the investment will generate a return. Lenders will scrutinize this budget to assess the feasibility of your plan and your ability to manage the borrowed funds effectively. Failing to provide a comprehensive and well-reasoned budget is a common reason for loan applications to be rejected.

In essence, a clear plan for the use of funds isn’t just a requirement for obtaining a loan; it’s a critical component of responsible business management. It demonstrates to lenders your seriousness, your preparedness, and your commitment to the success of your venture, significantly increasing your chances of securing the necessary funding.

Understanding Your Current Cash Flow

Before you even consider applying for a business loan, it’s crucial to have a thorough understanding of your current cash flow. This involves more than just looking at your bank balance; it requires a detailed analysis of your income and expenses over a specific period, typically the last three to six months.

Positive cash flow indicates that your business is generating more money than it’s spending, a vital sign of financial health. This makes you a more attractive candidate for a loan as lenders are more confident in your ability to repay the debt. However, even with positive cash flow, it’s important to understand the magnitude. A small positive cash flow might not be sufficient to support a large loan.

Conversely, negative cash flow, where expenses exceed income, presents a significant challenge. Lenders will be wary of providing a loan in this situation, as it suggests an inability to manage finances and meet repayment obligations. Analyzing your cash flow will help you identify areas where you can cut costs or increase revenue to improve your financial standing before applying for a loan.

To accurately assess your cash flow, you should prepare a cash flow statement. This document provides a clear picture of your inflows and outflows of cash, highlighting your net cash flow. Consider using accounting software or consulting with a financial advisor to ensure accuracy and gain insights into your financial trends. Understanding your current cash flow is not just about securing a loan; it’s about ensuring the long-term sustainability of your business.

Remember, lenders look for stability and predictability in cash flow. Fluctuations can raise concerns, so demonstrating a consistent pattern, even with modest positive cash flow, is preferable to sporadic high earnings followed by periods of significant losses. A clear and accurate picture of your current cash flow is your first step towards a successful loan application.

How to Time Your Application with Business Cycles

Timing your business loan application strategically with the economic cycle can significantly impact your chances of approval and the terms you receive. Understanding the current business cycle – whether it’s expansion, peak, contraction, or trough – is crucial. Different stages present unique opportunities and challenges for loan applicants.

During periods of economic expansion, lenders are generally more optimistic and willing to take on risk. This often translates into more favorable loan terms, such as lower interest rates and more flexible repayment options. However, competition for loans can be fierce during expansionary periods, so a strong business plan and impeccable financial statements are essential.

Conversely, during economic contractions or recessions, lenders become more cautious and conservative. They may tighten lending standards, resulting in stricter requirements and higher interest rates. Securing a loan during a downturn can be more challenging, but it can also present opportunities if your business demonstrates resilience and strong potential for growth despite the economic headwinds. A detailed financial forecast showcasing your business’s ability to withstand the economic downturn is critical during this time.

Peak and trough phases represent transitional points. The peak signifies the end of expansion, where lenders may start to become more discerning. The trough marks the bottom of a contraction, where some lenders may begin to loosen their standards in anticipation of a recovery. Careful monitoring of economic indicators is vital to identify these transitional points.

In addition to understanding the broad business cycle, you should also consider the seasonal cycles specific to your industry. Certain industries experience predictable fluctuations throughout the year. For example, a retail business might seek funding in advance of the holiday shopping season. Aligning your loan application with periods of high demand within your industry can significantly strengthen your application.

Ultimately, successfully timing your loan application requires careful analysis of both macroeconomic and industry-specific factors. Consulting with a financial advisor can provide valuable insights and guidance in navigating the complexities of the business cycle and optimizing your chances of securing a loan on favorable terms.

Seasonality and Growth Opportunities

Understanding the seasonality of your business is crucial when applying for a business loan. Different industries experience peak and slow periods throughout the year, directly impacting your revenue stream and, consequently, your loan application’s strength.

For example, a retailer might experience significantly higher sales during the holiday season, while a landscaping company sees increased demand in the spring and summer months. A strong understanding of these fluctuations allows you to accurately forecast future revenue and demonstrate to lenders your ability to repay the loan, even during slower periods. Accurate projections showcasing consistent cash flow, even accounting for seasonal downturns, significantly improve your chances of approval.

Furthermore, recognizing your business’s seasonal trends can help you identify growth opportunities. If your business experiences a predictable surge in demand at a specific time of year, you may want to leverage a loan to invest in inventory, marketing campaigns, or staffing to capitalize on this peak season. This proactive approach demonstrates foresight and a strategic understanding of your market, presenting a more compelling case for loan approval.

Conversely, you might consider applying for a loan during a slower period to prepare for the upcoming peak season. This allows you to secure funding without the pressure of immediate high-demand needs, facilitating more careful planning and maximizing the impact of your investment. The lender will appreciate your forward-thinking approach and your demonstrated financial responsibility.

Ultimately, aligning your loan application with your business’s seasonal cycle allows you to present a more complete and persuasive financial picture. This increases your likelihood of securing the funding necessary to achieve your business goals and successfully navigate periods of both high and low demand.

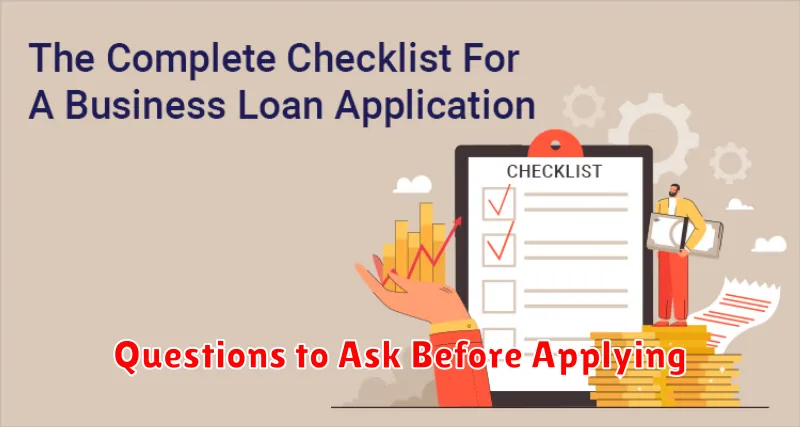

Questions to Ask Before Applying

Before submitting a business loan application, it’s crucial to thoroughly assess your situation. A well-prepared application significantly increases your chances of approval. Take the time to honestly answer these key questions.

What type of loan is best suited for my needs? Different loans cater to various business needs and financial situations. Understanding the distinctions between term loans, lines of credit, SBA loans, and other options is essential for selecting the most appropriate financing.

Have I explored all other funding options? Consider bootstrap financing, investor funding, or selling assets before resorting to a loan. Demonstrating that you’ve exhausted other avenues can strengthen your loan application.

What is my credit score and how can I improve it? Creditworthiness is a major factor in loan approval. A high credit score significantly improves your chances. Check your credit report and take steps to address any negative marks.

What is my debt-to-income ratio? Lenders carefully examine your debt-to-income ratio (DTI). A lower DTI demonstrates your ability to manage debt effectively, making you a more attractive borrower.

Do I have a solid business plan? A comprehensive business plan outlining your business model, financial projections, and repayment strategy is vital. It demonstrates your understanding of the business and your ability to repay the loan.

What are the loan terms and conditions? Carefully review all loan terms, including interest rates, fees, repayment schedules, and any collateral requirements. Understand the full implications before signing any agreements.

Can I comfortably afford the monthly payments? Accurate cash flow projections are necessary to determine if you can comfortably handle the monthly loan repayments without jeopardizing your business’s financial health.

Have I prepared all the necessary documentation? Lenders require various documents to verify your financial information. Gather all necessary materials, such as tax returns, bank statements, and business licenses, in advance to streamline the application process.