Are you considering a home purchase but unsure about the intricacies of Private Mortgage Insurance (PMI)? Understanding PMI is crucial for prospective homeowners, as it significantly impacts your mortgage and overall homeownership costs. This comprehensive guide will demystify PMI, explaining what it is, when it’s required, how much it costs, and, most importantly, how to eliminate it from your monthly mortgage payments. We’ll cover essential aspects like loan-to-value ratios (LTV), down payment requirements, and strategies for removing PMI once you’ve built sufficient equity in your home.

This article provides a clear and concise explanation of Private Mortgage Insurance, designed to empower you with the knowledge necessary to navigate the complexities of home financing. We will explore the benefits and drawbacks of PMI, offering practical advice and actionable steps to manage your mortgage effectively. Learn how to avoid unnecessary PMI costs and achieve your homeownership goals with confidence. Gain a thorough understanding of PMI requirements and discover strategies for eliminating PMI sooner rather than later, saving you considerable money in the long run.

What Is PMI and Who Has to Pay It

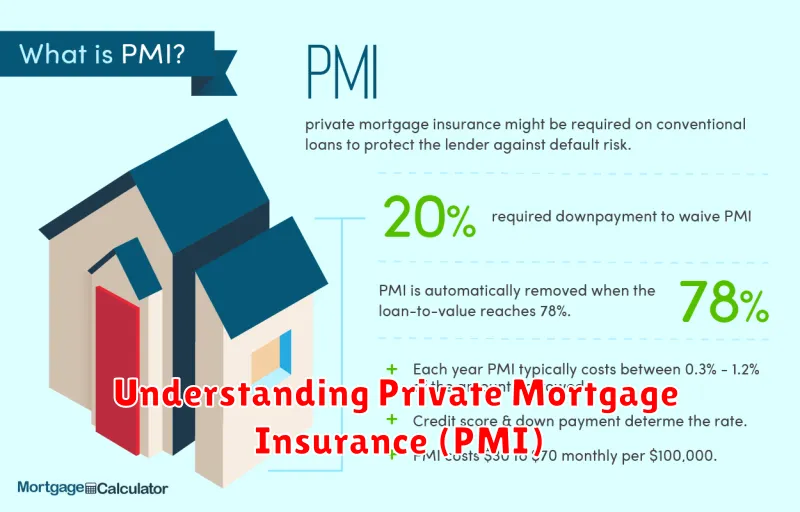

Private Mortgage Insurance, or PMI, is an insurance policy that protects lenders if a borrower defaults on their mortgage loan. It’s essentially a safety net for the lender, guaranteeing them repayment even if the homeowner fails to make their payments.

Who has to pay PMI? Borrowers who obtain a conventional loan and make a down payment of less than 20% of the home’s purchase price are typically required to pay PMI. This is because a smaller down payment increases the lender’s risk. The less equity a homeowner has in their home, the higher the likelihood of default.

It’s important to note that PMI is not required for all mortgage loans. For example, FHA loans, VA loans, and USDA loans have their own insurance programs and do not typically require PMI. Additionally, some lenders may offer alternatives to PMI for borrowers with less than 20% down payment, such as a higher interest rate or a larger down payment over time.

The cost of PMI is added to the borrower’s monthly mortgage payment and is typically expressed as a percentage of the loan amount. This percentage can vary depending on several factors, including the borrower’s credit score and the loan-to-value ratio (LTV).

While PMI protects the lender, it represents an added expense for the borrower. Understanding the requirements and costs of PMI is crucial for prospective homeowners to accurately budget for their mortgage payments.

When PMI Is Required on a Mortgage

Private Mortgage Insurance (PMI) is typically required when you take out a conventional loan and make a down payment of less than 20% of the home’s purchase price. This is because lenders consider loans with smaller down payments to be higher risk.

The 20% threshold is a key factor. If you put down less than this amount, the lender will almost certainly require you to obtain PMI to protect their investment. The PMI acts as a safety net for the lender in case you default on your mortgage payments.

It’s important to note that even if you have excellent credit, you’ll likely still need PMI if your down payment is below 20%. Your credit score affects your interest rate, but it doesn’t eliminate the need for PMI in this scenario.

There are some exceptions. Certain government-backed loans, such as FHA loans and VA loans, have their own insurance requirements, and these typically don’t involve PMI. These loans often have different down payment requirements and other eligibility criteria.

Furthermore, some lenders may offer specialized loan programs that may waive PMI even with down payments less than 20%. However, these programs usually come with stricter eligibility requirements and might carry higher interest rates. It’s crucial to shop around and compare options.

How Much PMI Typically Costs

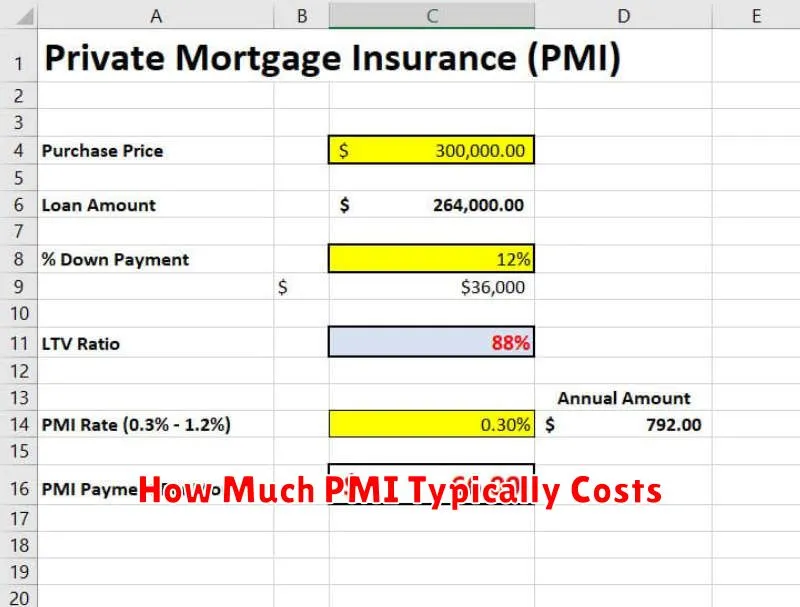

The cost of Private Mortgage Insurance (PMI) varies depending on several factors. A key determinant is your loan-to-value ratio (LTV), which is the percentage of the home’s value that you’re borrowing. The lower your down payment, the higher your LTV and consequently, the higher your PMI premium.

PMI is typically expressed as an annual percentage rate (APR), but you usually pay it monthly as part of your mortgage payment. This annual percentage is then divided by 12 to determine your monthly PMI payment. The range of typical annual PMI rates can vary, but it generally falls between 0.5% and 1% of the total loan amount.

For example, if you have a $300,000 mortgage and your PMI rate is 0.75%, your annual PMI cost would be $2,250 ($300,000 x 0.0075). Your monthly PMI payment would then be approximately $187.50 ($2,250 / 12).

Other factors influencing the cost include your credit score. A higher credit score typically translates to a lower PMI rate. The type of loan also matters; some loan types may have higher or lower PMI premiums associated with them. Finally, the lender you choose will also impact your final PMI cost, as lenders have varying pricing structures.

It’s crucial to shop around and compare quotes from multiple lenders to secure the most favorable PMI rate. Understanding these factors and carefully comparing offers will help you make an informed decision and minimize your overall PMI expense.

How PMI Affects Your Monthly Payment

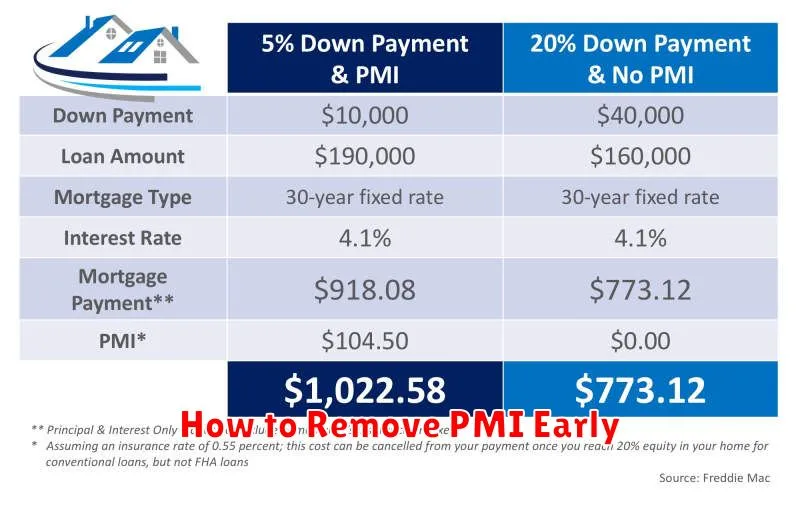

Private Mortgage Insurance, or PMI, significantly impacts your monthly mortgage payment. It’s an added cost you’ll pay in addition to your principal, interest, taxes, and insurance (PITI).

The amount of your PMI payment depends on several factors, including your loan-to-value ratio (LTV), the size of your loan, and prevailing interest rates. A higher LTV generally translates to a higher PMI premium, as it represents a greater risk for the lender.

PMI is typically expressed as a percentage of your loan amount. This percentage is then divided by 12 to determine your monthly PMI payment. For example, a 0.5% PMI on a $300,000 loan would result in a monthly PMI payment of $125. This is in addition to your principal and interest payments, property taxes, and homeowners insurance.

It’s crucial to understand that PMI payments are added to your overall monthly mortgage payment, potentially increasing your housing costs considerably. This added expense can make budgeting and financial planning more challenging.

The impact of PMI on your monthly budget should be a key consideration when purchasing a home. Carefully calculating the total monthly payment, including PMI, will help you determine whether you can afford the home comfortably.

How to Remove PMI Early

Private Mortgage Insurance (PMI) is designed to protect lenders if a borrower defaults on their mortgage. While it’s typically required when you make a down payment of less than 20% of the home’s purchase price, there are ways to remove PMI early, saving you on monthly payments.

One common method is to reach 20% equity in your home. This can be achieved through paying down your principal balance over time, or through an increase in your home’s value. You’ll need to obtain an appraisal to verify the increased value and demonstrate you’ve reached the 20% equity threshold. This process can take several years, depending on your mortgage terms and the rate of home appreciation.

Another option involves refinancing your mortgage. If your home’s value has increased sufficiently, refinancing to a new loan with a lower loan-to-value ratio (LTV) may allow you to eliminate PMI. This will involve securing a new mortgage with a different lender, and will be contingent upon your credit score and financial standing.

It’s crucial to contact your lender directly to understand their specific requirements for PMI cancellation. They can provide you with the exact steps and documentation needed to remove PMI from your mortgage. Requirements can vary depending on the type of loan and your lender’s policies. Be prepared to provide proof of your home’s current value and your updated loan-to-value ratio.

Finally, be aware of potential fees associated with removing PMI. While some lenders may not charge any fees, others might impose charges for the appraisal or other processing costs. Make sure to inquire about these costs during your communication with the lender to avoid unexpected expenses.

Alternatives to PMI You Might Consider

If you’re facing the prospect of paying Private Mortgage Insurance (PMI), it’s understandable to explore alternatives. The cost of PMI can be significant, adding hundreds of dollars to your monthly mortgage payment. Fortunately, several options might allow you to avoid or minimize this expense.

One primary alternative is to increase your down payment. PMI is typically required when your down payment is less than 20% of the home’s purchase price. By saving more for a larger down payment, you can eliminate the need for PMI altogether. This upfront investment can lead to substantial long-term savings.

Another avenue is exploring government-backed loans such as FHA loans. While these loans often have their own insurance premiums (MIP), the rates may be lower than private PMI, and the requirements for qualifying might be more lenient for some borrowers. It’s crucial to compare the overall costs of different loan types to determine the most beneficial option for your individual financial situation.

Consider looking into different loan programs offered by various lenders. Some lenders offer specialized programs that may reduce or eliminate the need for PMI, especially for borrowers with excellent credit scores and stable financial histories. It’s important to shop around and compare offers from multiple lenders to find the most favorable terms.

Finally, you might consider exploring the possibility of a co-borrower. Adding a co-borrower with strong credit and income could improve your overall financial profile, making you a less risky borrower and potentially reducing the lender’s need to require PMI. This option, however, requires careful consideration of the implications for all parties involved.