Understanding your Loan-to-Value (LTV) ratio is crucial when applying for a mortgage. This ratio, calculated by dividing the loan amount by the property’s appraised value, significantly impacts your ability to secure a mortgage and the terms you’ll receive. A lower LTV ratio generally translates to better mortgage rates, potentially lower down payments, and more favorable loan options. This article will explore the critical role LTV plays in the mortgage process and how it affects your overall borrowing experience. We’ll examine how different LTV ratios influence interest rates, down payment requirements, and the availability of various mortgage products.

Factors influencing your LTV, such as the property’s appraised value and the size of your down payment, are key determinants of your mortgage approval and the associated costs. Knowing how to improve your LTV can help you achieve a more favorable mortgage rate and reduce the overall cost of borrowing. This detailed guide will equip you with the knowledge needed to navigate the complex world of mortgages and make informed decisions regarding your loan-to-value ratio, ultimately securing the best possible mortgage for your financial situation. Learn how to calculate your LTV, understand the implications of high versus low ratios, and discover strategies to optimize your LTV for mortgage success.

What Is Loan-to-Value Ratio?

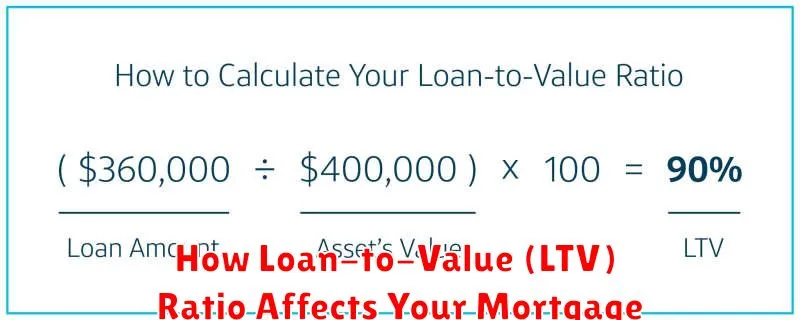

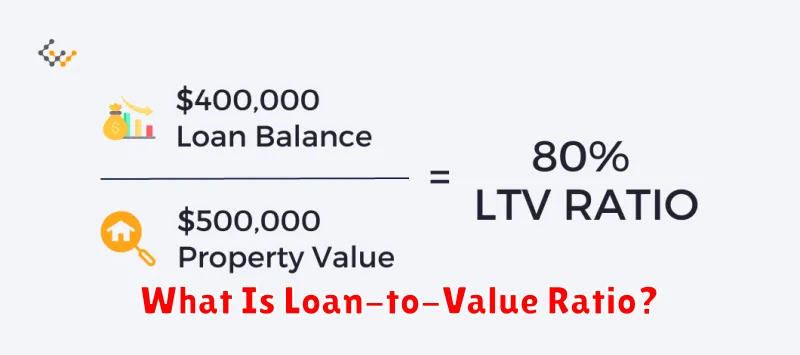

The loan-to-value ratio (LTV) is a crucial financial metric used primarily in the mortgage industry. It represents the relationship between the amount of a mortgage loan and the value of the property being purchased or used as collateral.

In simpler terms, the LTV ratio expresses the loan amount as a percentage of the property’s appraised value. For example, if you borrow $200,000 to purchase a home valued at $250,000, your LTV ratio would be 80% (calculated as $200,000 / $250,000 x 100%).

This ratio is a critical factor for lenders when assessing the risk associated with a mortgage. A higher LTV indicates a higher risk for the lender, as the loan amount is a larger proportion of the property’s value. Conversely, a lower LTV signifies a lower risk, since there’s more equity in the property to act as a buffer against potential losses.

Understanding your LTV is important because it directly impacts several aspects of your mortgage, including the interest rate you’ll be offered and whether you’ll be required to purchase private mortgage insurance (PMI). Lenders often adjust interest rates based on LTV, with lower LTVs typically resulting in more favorable interest rates.

Why LTV Matters to Lenders and Borrowers

The Loan-to-Value (LTV) ratio is a crucial factor in the mortgage lending process, impacting both lenders and borrowers significantly. It represents the loan amount as a percentage of the property’s value. Understanding its implications is vital for a successful and secure mortgage transaction.

For lenders, the LTV ratio is a key indicator of risk. A lower LTV (e.g., 60%) suggests a smaller loan relative to the property’s worth, signifying less risk of default. This allows lenders to offer more favorable terms, such as lower interest rates and potentially more flexible repayment options. Conversely, a higher LTV (e.g., 90%) indicates a greater risk, potentially leading to higher interest rates and stricter lending criteria to compensate for the increased risk of loss in case of foreclosure.

From the borrower’s perspective, the LTV ratio directly affects their ability to secure a mortgage and the terms they receive. A lower LTV often translates to better mortgage rates and potentially lower down payments, making homeownership more accessible. However, achieving a lower LTV often requires a larger down payment, which may not be feasible for all borrowers. Conversely, a higher LTV might necessitate private mortgage insurance (PMI), increasing the overall cost of the mortgage. Furthermore, a high LTV may result in a more stringent approval process, requiring more thorough documentation and credit checks.

In essence, the LTV ratio acts as a balancing act between the risk assessment of the lender and the financial capacity and goals of the borrower. Understanding this interplay is crucial for both parties to navigate the mortgage process effectively and make informed decisions.

How LTV Impacts Interest Rates and Terms

Your Loan-to-Value (LTV) ratio, calculated by dividing the loan amount by the property’s appraised value, significantly influences the interest rate and terms you’ll receive on your mortgage. A lower LTV generally translates to better terms.

Lower LTV ratios (e.g., below 80%) are viewed as less risky by lenders. This is because there’s a larger equity cushion, meaning the borrower has more invested in the property. As a result, lenders are more willing to offer lower interest rates and potentially more favorable loan terms, such as a longer repayment period or a reduced down payment requirement. They might also offer access to a wider range of loan products.

Conversely, a higher LTV ratio (e.g., above 80%, especially above 90%) indicates a higher risk for lenders. This is because a significant portion of the property’s value is financed through the loan, leaving less equity for the borrower. Lenders often mitigate this risk by charging higher interest rates and potentially requiring private mortgage insurance (PMI). PMI protects the lender in case of default. Higher LTV ratios might also result in stricter loan approval criteria and potentially less favorable loan terms.

The impact of LTV on interest rates and terms isn’t always linear. Different lenders have different risk tolerance levels and pricing strategies. However, understanding the relationship between your LTV and the loan you receive is crucial in securing the best possible mortgage.

LTV and Down Payment Relationship

The loan-to-value (LTV) ratio and the down payment are intrinsically linked; they represent two sides of the same coin. The LTV ratio is calculated by dividing the loan amount by the property’s appraised value. Conversely, the down payment is the percentage of the property’s purchase price that you pay upfront, reducing the amount you need to borrow.

A higher down payment directly translates to a lower LTV ratio. For example, a 20% down payment on a $300,000 home means a loan amount of $240,000, resulting in an LTV of 80% ($240,000/$300,000). Conversely, a 10% down payment on the same home would lead to a loan of $270,000 and an LTV of 90%.

This relationship is crucial because lenders use the LTV ratio to assess risk. A lower LTV ratio generally signifies lower risk for the lender, as a larger down payment provides a financial cushion in case of default. This often leads to more favorable mortgage terms, such as lower interest rates and potentially reduced fees.

Conversely, a higher LTV ratio (meaning a smaller down payment) presents greater risk to the lender. This increased risk can result in higher interest rates, private mortgage insurance (PMI) requirements, and potentially more stringent lending criteria. In some cases, a very high LTV might even disqualify a borrower from obtaining a mortgage altogether.

Therefore, understanding the relationship between your down payment and the resulting LTV is vital in securing the most advantageous mortgage terms. Carefully considering your financial situation and how it impacts your LTV is a key step in the home-buying process.

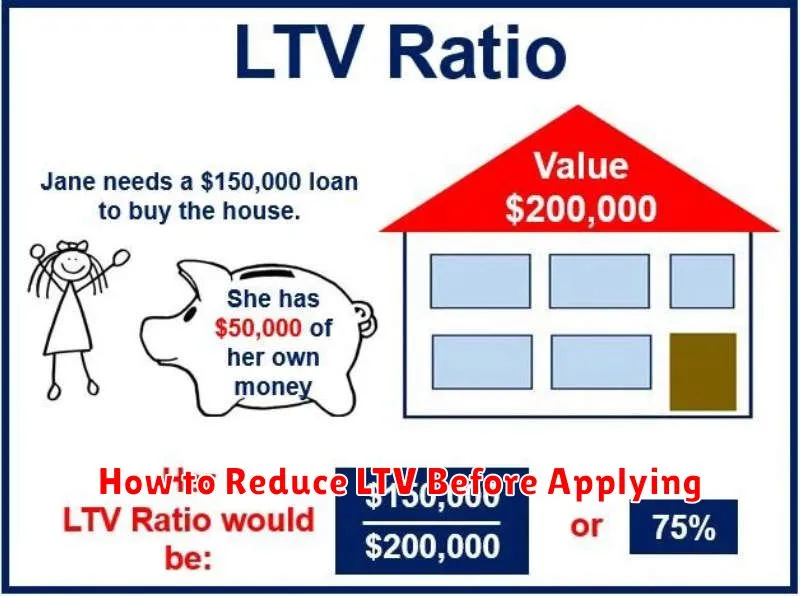

How to Reduce LTV Before Applying

A lower Loan-to-Value (LTV) ratio is highly desirable when applying for a mortgage, as it often translates to better interest rates and more favorable loan terms. Reducing your LTV before applying can significantly improve your chances of approval and potentially save you considerable money over the life of the loan.

One of the most effective ways to reduce your LTV is to increase your down payment. Saving more money for a larger down payment directly decreases the loan amount you need, thereby lowering your LTV. Even a small increase in your down payment can make a noticeable difference.

Another strategy involves paying down existing debt. Lenders consider your overall debt-to-income ratio when assessing your application. Reducing high-interest debt, such as credit card balances, can positively impact your credit score and improve your LTV. This demonstrates better financial responsibility and reduces your overall financial burden.

Improving your credit score is also crucial. A higher credit score signifies lower risk to lenders, potentially allowing for a lower LTV or better loan terms. Paying bills on time, keeping credit utilization low, and maintaining a diverse credit history are key factors in improving your creditworthiness.

Consider exploring options to increase your income. A higher income can improve your debt-to-income ratio, strengthening your application and potentially allowing you to qualify for a lower LTV loan. This could involve seeking a promotion, taking on a part-time job, or exploring other avenues for supplemental income.

Finally, shop around and compare offers from multiple lenders. Different lenders may have varying requirements and may be more flexible regarding LTV ratios. Comparing loan terms and interest rates can help you find the best possible deal.

Understanding LTV Limits for Different Mortgage Types

The Loan-to-Value (LTV) ratio is a crucial factor in determining your mortgage eligibility and interest rate. It represents the percentage of a property’s value that is covered by the loan. LTV limits vary significantly depending on the type of mortgage you’re seeking.

Conventional loans, those not insured by the government, typically have stricter LTV limits. These limits often range from 80% to 95%, meaning you’ll need a down payment of at least 5% to 20%. LTVs exceeding 80% might require private mortgage insurance (PMI), increasing your monthly payments. The exact limit can vary depending on the lender and the borrower’s credit score.

FHA loans, insured by the Federal Housing Administration, generally allow for higher LTV ratios, often up to 96.5%. This makes them more accessible to borrowers with smaller down payments. However, you’ll pay an upfront mortgage insurance premium (UFMIP) and an annual premium. These insurance premiums are intended to protect the lender in case of default.

VA loans, guaranteed by the Department of Veterans Affairs, can sometimes offer 100% financing, meaning no down payment is required. This is a significant advantage for eligible veterans, but it’s subject to certain qualifications and appraisals. While there’s no PMI, VA loans do involve a funding fee.

USDA loans, backed by the United States Department of Agriculture, are designed for rural homebuyers. Similar to FHA loans, they often permit higher LTV ratios and can be attractive options for those in eligible rural areas. The specific LTV limits and associated fees vary based on location and program details.

Understanding these LTV limits and their implications for different mortgage types is essential for planning your home purchase. It impacts not only the amount you need for a down payment but also the insurance premiums, interest rates, and overall cost of borrowing.