Understanding mortgage amortization is crucial for any homeowner. This process, which details how your monthly mortgage payments are applied over the life of your loan, can seem complex, but grasping its fundamentals empowers you to make informed financial decisions. This article will break down how your principal and interest payments change over time, explaining the mechanics behind your amortization schedule and revealing how you gradually build home equity. Learn how to interpret your amortization table and gain insights into the true cost of your mortgage.

We’ll explore the amortization formula and show you how it works in practice. You’ll discover how the proportion of your payment allocated to interest versus principal shifts throughout your loan term. This understanding is vital for assessing the long-term cost of your mortgage and for strategizing potential refinancing opportunities. Mastering mortgage amortization allows you to effectively manage your debt and optimize your financial planning for a secure future.

What Is Mortgage Amortization?

Mortgage amortization is the process of gradually paying off a mortgage loan over a set period of time through regular payments. These payments are typically made monthly and consist of both principal and interest.

The principal represents the original loan amount borrowed, while the interest is the cost of borrowing that money. In the early stages of a mortgage, a larger portion of each payment goes towards interest, with a smaller amount applied to the principal. As time progresses, the proportion shifts, with more of each payment going towards the principal and less towards the interest.

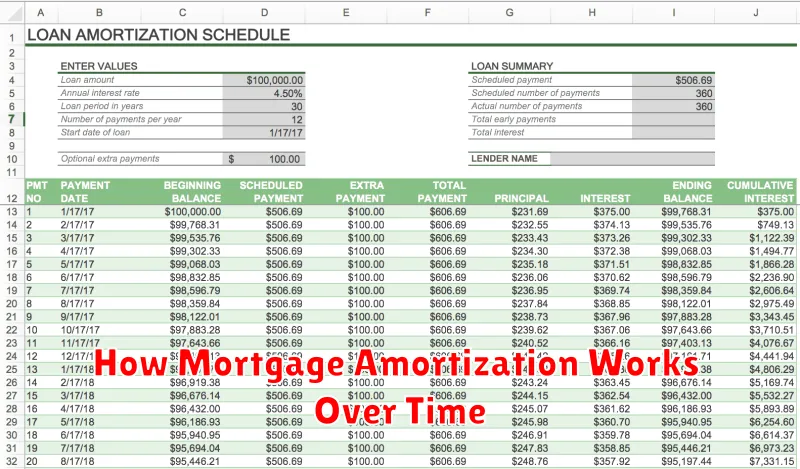

An amortization schedule is a detailed table that shows the breakdown of each payment over the life of the loan. It illustrates the exact amount allocated to principal and interest for each payment, as well as the remaining loan balance after each payment. This allows borrowers to track their loan payoff progress and visualize how their payments are reducing their debt.

Understanding mortgage amortization is crucial for borrowers. It provides a clear picture of how much they will pay overall, and how the balance of the loan decreases over time. This understanding empowers borrowers to make informed financial decisions and manage their mortgage effectively.

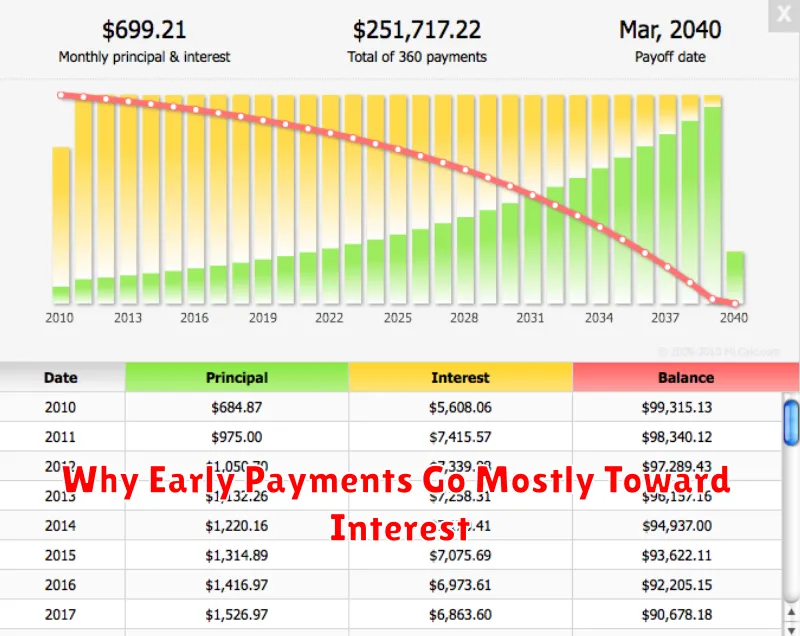

Why Early Payments Go Mostly Toward Interest

In the early stages of a mortgage, a significantly larger portion of your monthly payment goes towards interest rather than principal. This is due to the way amortization schedules are structured.

Your monthly payment is calculated based on a formula that determines a fixed amount you’ll pay each month over the loan’s term. This fixed payment covers both interest and principal. However, in the beginning, a greater portion of this payment is allocated to cover the interest accrued on the outstanding loan balance. This is because the outstanding loan balance, against which interest is calculated, is highest at the start of the loan.

Think of it this way: Imagine you borrow $300,000. The interest is calculated on this full amount initially. As you make payments, a small portion goes towards reducing the principal balance, while the bulk of the payment goes toward covering the interest. Only after several years, when a substantial part of the principal has been paid, will a larger portion of your monthly payment begin to reduce the principal balance.

This is a crucial concept to understand when considering strategies like making extra principal payments. While you’ll pay off your mortgage faster and save money on interest in the long run, the early extra payments will disproportionately reduce the interest accrued over the remaining loan term. You may not see a dramatic reduction in the total time to pay off your mortgage in the first few years, even with significant extra payments.

The effect is a gradual shift in the allocation of your monthly payment. As the principal balance decreases, a larger proportion of each subsequent payment is applied to the principal, thus accelerating the payoff of the loan.

Amortization Schedules Explained Simply

An amortization schedule is a detailed table that shows the breakdown of each payment made on a loan, such as a mortgage. It outlines the allocation of each payment towards the principal (the original loan amount) and the interest. Understanding this schedule is crucial for borrowers to grasp how their loan is being repaid over time.

Each row in the schedule represents a payment period (typically monthly). For each period, it shows the payment amount, the portion applied to interest, the portion applied to principal, and the remaining principal balance. The interest portion is generally highest in the early stages of the loan and gradually decreases as the principal balance reduces. Conversely, the principal portion increases over time.

Key components visible on an amortization schedule include:

- Beginning Balance: The outstanding loan amount at the start of the period.

- Payment Amount: The fixed monthly payment amount throughout the loan term.

- Interest Payment: The portion of the payment applied towards interest.

- Principal Payment: The portion of the payment applied towards the principal balance.

- Ending Balance: The remaining loan amount at the end of the period.

By examining an amortization schedule, borrowers can easily track their loan repayment progress, see how much interest they are paying each month, and determine the total interest paid over the life of the loan. It provides transparency and helps borrowers make informed financial decisions.

While many lenders provide amortization schedules, several online calculators are also available to generate personalized schedules based on individual loan parameters such as the loan amount, interest rate, and loan term. These tools empower borrowers to understand the long-term financial implications of their loan before committing to it.

How to Read Your Mortgage Statement

Understanding your mortgage statement is crucial for responsible homeownership. It provides a detailed breakdown of your loan’s current status and your payment activity. Let’s explore the key components.

Loan Balance: This figure represents the remaining principal amount you owe on your mortgage. It decreases with each payment you make.

Payment Amount: This shows the total amount you paid for the period covered by the statement, usually a month. This includes both principal and interest.

Principal: This portion of your payment directly reduces the loan balance. As you make payments, a larger percentage goes towards the principal and a smaller percentage towards interest.

Interest: This is the cost of borrowing money, calculated as a percentage of your loan balance. Interest payments are typically higher in the early stages of your mortgage and gradually decrease over time.

Escrow Account: Many mortgage statements include an escrow section. This is a separate account managed by your lender that holds funds for property taxes and homeowners insurance. Your monthly payment includes an amount allocated to your escrow account.

Late Fees: If you made a late payment, this section will detail any applicable fees. Paying your mortgage on time is crucial to avoid these charges.

Payment History: This portion shows a record of your past payments, indicating the date and amount of each payment made. It serves as a valuable reference for tracking your payment history.

Regularly reviewing your mortgage statement enables you to monitor your loan progress, track your payments, and verify that the amounts are correctly applied. Any discrepancies should be reported promptly to your lender.

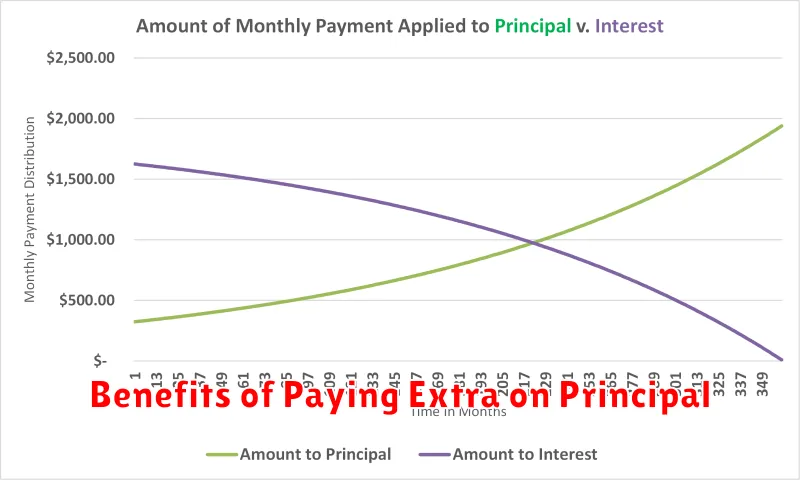

Benefits of Paying Extra on Principal

Paying extra towards your mortgage principal offers several significant advantages that can substantially impact your financial future. One of the most obvious benefits is a reduction in the overall loan term. By making additional payments, you accelerate the repayment schedule, potentially saving you years of interest payments.

Another key advantage is significant interest savings. A substantial portion of your early mortgage payments goes towards interest. By paying down the principal faster, you reduce the amount of interest accrued over the life of the loan, leading to considerable cost savings. These savings can be substantial, amounting to thousands or even tens of thousands of dollars, depending on the loan amount and interest rate.

Beyond the financial benefits, paying extra on your principal offers significant psychological peace of mind. Watching your loan balance decrease more rapidly can be incredibly motivating and provides a sense of accomplishment. This can be especially beneficial for homeowners who are stressed about their mortgage debt.

Moreover, accelerated principal payments can improve your overall financial health. By freeing up cash flow sooner, you can allocate more resources towards other financial goals, such as investing, saving for retirement, or paying off other debts. This can lead to greater long-term financial stability and security.

Finally, it’s worth noting that the ability to make extra principal payments often depends on your individual financial circumstances and mortgage terms. It’s crucial to review your mortgage agreement and consult with your lender to understand any potential penalties or restrictions before making extra principal payments.

When Prepaying Might Not Be Ideal

While prepaying your mortgage can seem like a financially savvy move, leading to significant long-term savings on interest, it’s not always the best strategy. Several factors can make prepayment less than ideal, or even detrimental, to your overall financial health.

One key consideration is the opportunity cost. The money used to prepay your mortgage could potentially earn a higher return elsewhere. For example, investing that money in a high-yield savings account, a diversified investment portfolio, or paying down high-interest debt could yield greater financial benefits than simply reducing your mortgage principal. Before making a significant prepayment, carefully evaluate your other investment opportunities.

Another factor to consider is your current financial situation. Prepaying a substantial portion of your mortgage can leave you with limited liquidity. This could create difficulties if unforeseen expenses arise, such as medical bills or unexpected home repairs. Maintaining an emergency fund is crucial, and depleting it to prepay your mortgage could leave you vulnerable.

Furthermore, the terms of your mortgage play a role. Some mortgages include prepayment penalties, effectively negating any savings achieved through early payment. Before prepaying, review your mortgage contract carefully to understand any associated fees or restrictions.

Finally, it’s important to consider your personal financial goals. If you have other pressing financial needs, such as saving for retirement, your children’s education, or a down payment on another property, those goals should often take precedence over accelerated mortgage repayment. Prioritize your long-term financial objectives and allocate your resources accordingly.