Are you struggling with multiple high-interest debts, such as credit cards, medical bills, or personal loans? Feeling overwhelmed by juggling minimum payments and accruing interest charges? This article explores the potential benefits of debt consolidation through personal loans as a strategic solution to simplify your finances and potentially save you money. We’ll delve into how a personal loan can help you combine multiple debts into one manageable monthly payment, potentially lowering your overall interest rate and improving your credit score. Understanding the process of debt consolidation is crucial for making informed financial decisions.

Debt consolidation with a personal loan offers a streamlined approach to managing your finances. By consolidating your debts, you gain clarity and control over your repayment schedule. This article will guide you through the essential steps involved in considering a personal loan for debt consolidation, including assessing your eligibility, comparing loan offers from different lenders, and understanding the potential risks and rewards. Learn how to determine if debt consolidation is the right strategy for your unique financial situation, and discover the practical steps to successfully navigate this process towards achieving financial freedom.

What Is Debt Consolidation and How Does It Work?

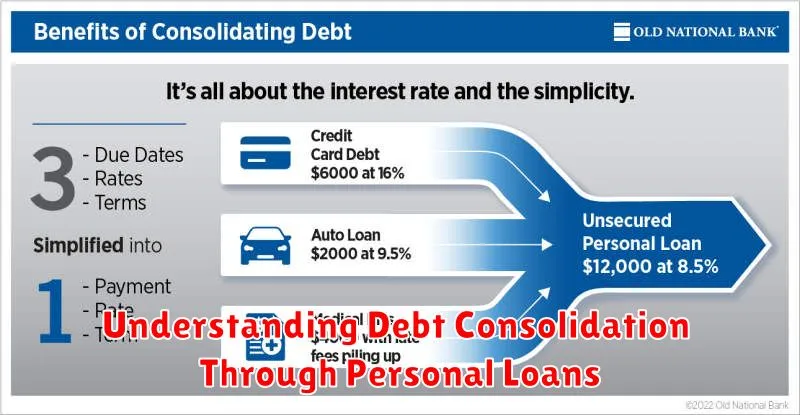

Debt consolidation is a financial strategy designed to simplify debt management by combining multiple debts into a single, new loan. This new loan, often a personal loan, pays off your existing debts, leaving you with just one monthly payment to manage.

The process typically involves obtaining a consolidation loan from a bank, credit union, or online lender. This loan should ideally offer a lower interest rate than your existing debts, saving you money on interest charges over the life of the loan. Once approved, the lender disburses funds to pay off your various credit cards, medical bills, personal loans, or other outstanding debts. You then make a single monthly payment to the lender, simplifying your financial obligations.

How it works in practice: Let’s say you have three credit cards with balances totaling $10,000, each charging high interest rates. Through debt consolidation, you could obtain a personal loan for $10,000 at a lower interest rate. The lender pays off your three credit cards, and you only need to make one monthly payment to the lender to repay the consolidated loan. This simplifies repayment and can potentially reduce your overall interest payments if the consolidation loan offers a significantly lower interest rate.

Important Considerations: While debt consolidation can be beneficial, it’s crucial to carefully consider the terms of the consolidation loan. A longer repayment period might result in paying more interest in the long run, even with a lower interest rate. Furthermore, securing a consolidation loan requires a good credit score and responsible financial habits. It’s essential to research different lenders and compare loan options before making a decision.

When a Personal Loan Can Help Consolidate Debt

Debt consolidation, the process of combining multiple debts into a single payment, can significantly simplify your financial life. A personal loan is a common tool used for this purpose, offering several key advantages.

One major benefit is simplification. Managing multiple loan payments, credit cards, and other debts can be overwhelming. A personal loan streamlines this process, reducing the number of payments and deadlines you need to track. This reduces the risk of missed payments and associated late fees.

Furthermore, a personal loan can offer a lower interest rate than your existing debts, particularly if you have high-interest credit cards. This can lead to significant savings over the life of the loan, accelerating your ability to become debt-free. The lower monthly payment, made possible by a lower interest rate and potentially a longer repayment term, contributes to improved cash flow.

A personal loan can be particularly helpful when dealing with high-interest debt, such as credit card debt. By consolidating these high-cost debts into a personal loan with a fixed interest rate, you gain predictability and control over your monthly expenses. This predictability is a powerful tool for budgeting and financial planning.

However, it’s crucial to remember that a personal loan is not a solution for every debt situation. Careful consideration of the loan terms, interest rate, and fees is essential before proceeding. Responsible use of a personal loan for debt consolidation can lead to improved financial health, but misuse can worsen your financial situation.

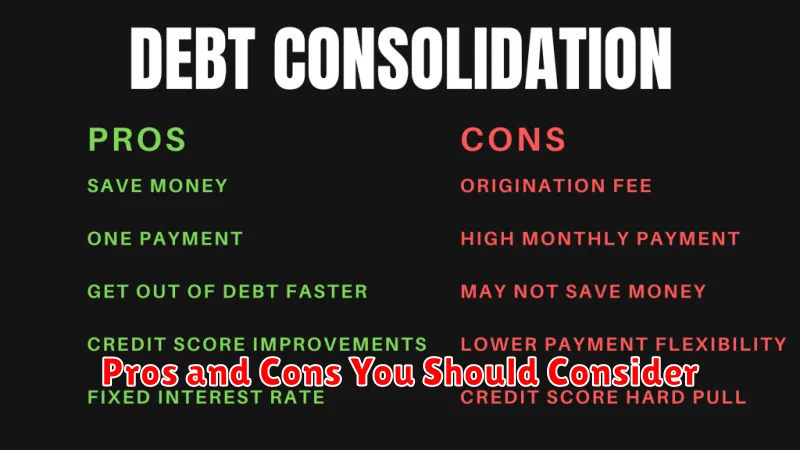

Pros and Cons You Should Consider

Debt consolidation through a personal loan offers several advantages. A primary benefit is simplification. Managing multiple debts with varying interest rates and due dates can be overwhelming. A personal loan consolidates these into a single, manageable monthly payment, making budgeting easier and reducing the risk of missed payments. This simplification also offers improved financial clarity, providing a clear picture of your debt and repayment progress.

Furthermore, a personal loan can lead to lower interest rates. If your existing debts carry high interest rates, consolidating them into a lower-rate personal loan can significantly reduce your overall interest payments and the total amount you repay. This can translate to substantial long-term savings.

However, it’s crucial to acknowledge the potential drawbacks. A personal loan is a new debt, and if not managed carefully, it can exacerbate your financial situation. A longer repayment term, while offering lower monthly payments, can result in paying more interest overall compared to aggressively paying down existing debts. Additionally, applying for and securing a personal loan requires a good credit score; those with poor credit might not qualify or might receive unfavorable terms.

Another important consideration is the potential impact on your credit score. While consolidating debts can improve your credit utilization ratio (the percentage of available credit you’re using) in the long run, the application process for a personal loan can temporarily lower your score. Careful planning and responsible debt management after consolidation are crucial to mitigate this risk.

Finally, it’s essential to understand the terms and conditions of the personal loan. Hidden fees, prepayment penalties, and inflexible repayment schedules can negate the benefits of consolidation. Thoroughly reviewing the loan agreement before signing is paramount to ensure it aligns with your financial goals and capabilities.

Impact on Credit Score Over Time

The impact of debt consolidation through a personal loan on your credit score is multifaceted and unfolds over time. Initially, applying for a new loan can lead to a temporary dip in your score because of a hard inquiry on your credit report. This is a minor impact, however, and typically resolves itself within a few months.

Following loan approval and responsible repayment, you’ll likely see a positive impact. Consolidation can reduce your credit utilization ratio—the percentage of available credit you’re using—which is a significant factor in your credit score. Paying down multiple high-interest debts into a single, lower-interest loan can dramatically improve this ratio, potentially boosting your score.

The consistent and on-time payments on your consolidated loan are crucial for continued score improvement. Regular, timely payments demonstrate responsible financial behavior, signaling to credit bureaus that you are a reliable borrower. This sustained positive behavior can lead to a substantial increase in your credit score over time.

However, it’s important to note that failing to make payments on the consolidated loan can have severely negative consequences. Late or missed payments can significantly damage your credit score and negate any positive impacts initially experienced. This underscores the importance of careful budgeting and commitment to repayment when pursuing debt consolidation.

Therefore, the overall effect on your credit score depends heavily on your responsible use of the consolidated loan and your commitment to consistently making timely payments. While a temporary dip is possible initially, the long-term prospects for credit score improvement are generally positive with disciplined repayment.

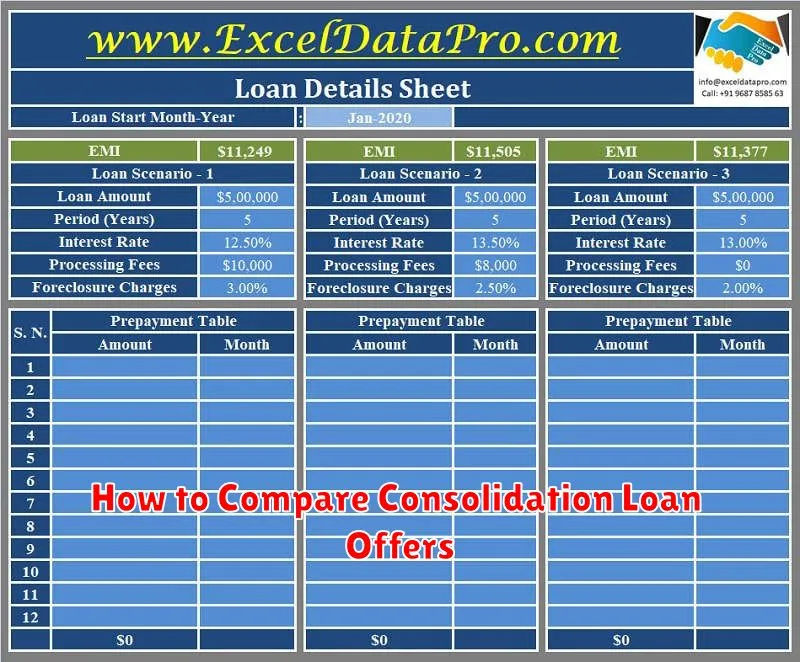

How to Compare Consolidation Loan Offers

Once you’ve received multiple offers for debt consolidation loans, comparing them is crucial to securing the best terms. Don’t just focus on the interest rate; a seemingly lower rate might hide higher fees or unfavorable repayment terms.

Begin by comparing the Annual Percentage Rate (APR). The APR considers not only the interest rate but also any associated fees, providing a more accurate reflection of the loan’s overall cost. A lower APR generally indicates a better deal.

Next, scrutinize the loan term. A shorter loan term means higher monthly payments but lower overall interest paid. Conversely, a longer term results in lower monthly payments but higher total interest. Carefully consider your budget and financial comfort level when choosing a loan term.

Examine all fees associated with each loan offer. These can include origination fees, prepayment penalties, and late payment fees. High fees can significantly impact the total cost of the loan, even if the interest rate is low. Compare the total cost of each loan, including all fees and interest, to make an informed decision.

Consider the loan provider’s reputation and customer service. Look for reviews and ratings online to get an idea of their reliability and responsiveness. A reputable lender will offer better protection against unexpected issues.

Finally, ensure the loan terms align with your financial goals. Choose a loan that allows you to comfortably manage your monthly payments without jeopardizing other financial obligations. Don’t be tempted by a low APR if it stretches your budget too thin.

Alternatives to Personal Loan Consolidation

While a personal loan can be an effective tool for debt consolidation, it’s not the only option. Several alternatives exist, each with its own advantages and disadvantages. The best choice depends heavily on your specific financial situation and the types of debt you’re trying to manage.

One strong alternative is a balance transfer credit card. These cards often offer a 0% introductory APR period, allowing you to pay down your debt without accruing interest for a specified time. However, it’s crucial to pay off the balance before the promotional period ends, as interest rates can become very high afterward. Furthermore, balance transfer fees may apply.

Another possibility is a debt management plan (DMP) offered through a credit counseling agency. A DMP involves negotiating lower interest rates and monthly payments with your creditors. This can simplify your finances by consolidating multiple payments into one, and it often includes financial education to improve your money management skills. However, a DMP can negatively impact your credit score.

For those with federal student loans, a consolidation program offered through the government can streamline repayment by combining multiple loans into a single monthly payment. Different repayment plans are available to suit various income levels and circumstances. This option avoids the higher interest rates often associated with private debt consolidation loans.

Finally, debt settlement might be considered as a last resort. This involves negotiating with creditors to pay off your debt for a reduced amount. However, it can significantly damage your credit score and may involve hefty fees. It’s generally advisable to explore other options before resorting to debt settlement.