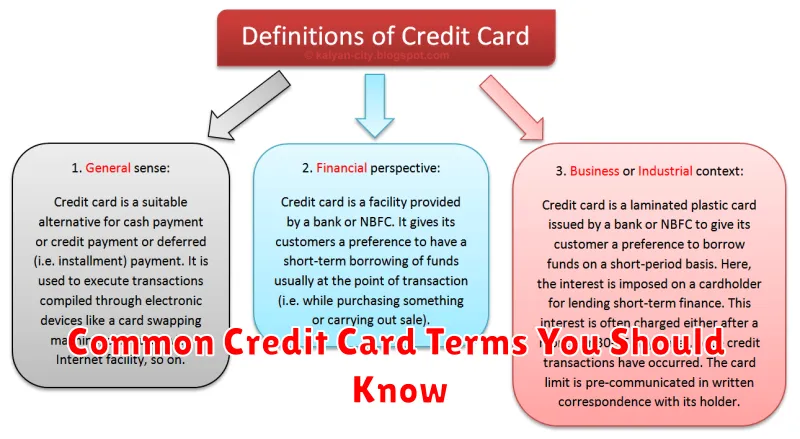

Understanding credit card terms is crucial for managing your finances effectively and avoiding potential pitfalls. Many individuals struggle with the complexities of credit card agreements, leading to missed payments, high interest charges, and damaged credit scores. This article will demystify common credit card terminology, empowering you to make informed decisions and navigate the world of credit with confidence. We’ll cover key concepts like APR, credit limit, grace period, and more, providing clear explanations to help you become a savvy credit card user.

From understanding your Annual Percentage Rate (APR) and its impact on your monthly payments to mastering the intricacies of minimum payments versus paying your balance in full, this guide will equip you with the knowledge to manage your credit card debt effectively. We’ll also delve into important considerations such as fees, rewards programs, and credit utilization ratio, all vital aspects of responsible credit card management. By the end of this article, you’ll have a firm grasp of the essential credit card terms needed to optimize your financial well-being.

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is the yearly interest rate charged on an outstanding balance on a credit card. It’s a crucial factor in understanding the true cost of borrowing money.

Unlike the nominal interest rate, which only represents the basic interest rate, the APR includes all fees and charges associated with the credit card account, effectively reflecting the total cost of credit. This makes it a more comprehensive measure than simply looking at the stated interest rate.

Several factors can influence your APR. These include your credit score, the type of card you have, and the credit card issuer’s policies. A higher credit score usually qualifies you for a lower APR. Similarly, secured credit cards typically carry higher APRs than unsecured ones.

It’s important to compare the APRs offered by different credit card issuers before choosing a card. A lower APR can significantly reduce the total amount of interest you’ll pay over time, leading to substantial savings. Paying attention to your APR helps ensure you’re getting the most favorable terms possible.

Understanding your APR is a critical component of responsible credit card management. Regularly reviewing your statement and comparing APRs are vital steps in minimizing interest charges and effectively managing your finances.

Minimum Payment and Billing Cycle

Understanding your credit card’s minimum payment and billing cycle is crucial for responsible credit card management. The minimum payment is the smallest amount you can pay each month without incurring late fees. It’s typically a small percentage of your total balance, often around 1% to 3%, plus any applicable interest and fees.

While making only the minimum payment may seem convenient, it’s generally not advisable. Paying only the minimum means you’ll accrue significantly more interest over time, resulting in a substantially higher total cost and extending the repayment period considerably. This can lead to a larger overall debt burden.

Your billing cycle is the period of time between your credit card statements. This is typically a monthly cycle, meaning you’ll receive a statement summarizing your transactions and balance at the end of each month. It’s essential to review your statement carefully to verify all transactions and ensure you understand your balance before making your payment. The due date for your payment is usually indicated on the statement; missing this date will lead to late payment fees.

Understanding both your minimum payment and billing cycle allows you to effectively manage your credit card debt and avoid unnecessary charges. Paying more than the minimum payment each month will help you reduce your balance faster, save on interest, and improve your credit score.

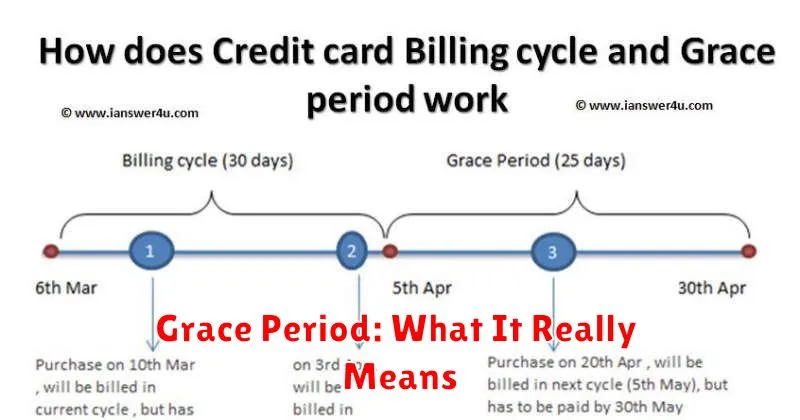

Grace Period: What It Really Means

A grace period is a crucial term in understanding your credit card agreement. It refers to the timeframe you have after your billing cycle ends to pay your statement balance in full without incurring any interest charges.

The length of the grace period varies depending on your credit card issuer. It’s typically around 21 to 25 days, but always check your cardholder agreement for the exact number of days you’re afforded. This period begins after the end of your billing cycle and the generation of your statement.

Important Note: The grace period only applies if you pay your entire statement balance by the due date. If you only make a partial payment, you’ll be charged interest on the remaining balance from the date of the purchase, not just from the due date. This is a significant difference and can lead to higher overall costs.

For example, if your statement shows a balance of $1,000 and the due date is August 15th, and your grace period is 21 days, you have until September 5th to pay the full $1,000 to avoid interest. Any amount less than the full balance means interest accrues from the date of each transaction.

Understanding your grace period is vital for managing your credit card effectively and minimizing interest payments. Always pay attention to your statement’s due date and the details outlined in your credit card agreement to fully utilize this benefit.

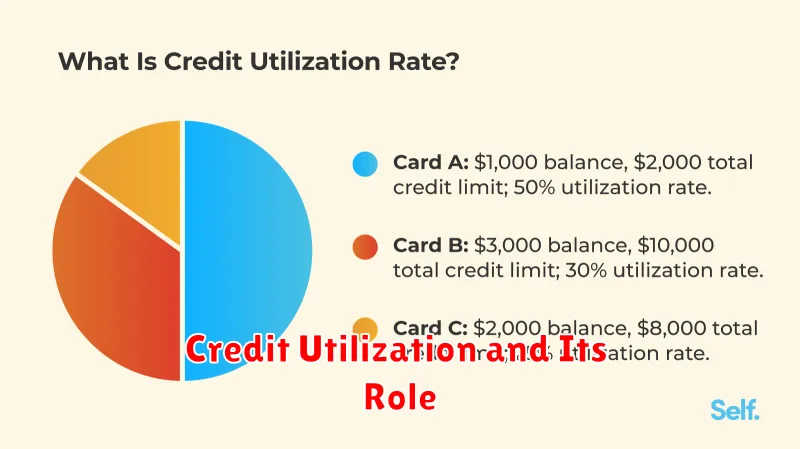

Credit Utilization and Its Role

Credit utilization is the ratio of your outstanding credit card balance to your total available credit. It’s a crucial factor in determining your credit score.

For example, if you have a credit card with a $1,000 credit limit and you owe $500, your credit utilization is 50%. This is calculated as (outstanding balance / credit limit) * 100.

Credit bureaus like Experian, Equifax, and TransUnion use credit utilization to assess your creditworthiness. A lower credit utilization ratio generally signifies responsible credit management, and thus contributes positively to your credit score. Conversely, a high credit utilization ratio indicates a greater reliance on credit, potentially suggesting increased risk to lenders.

Maintaining a low credit utilization ratio, ideally below 30%, is highly recommended for improving your credit score. Strategies to achieve this include paying down your balances regularly and requesting a credit limit increase if you have a long history of responsible credit use. Remember, even if you can afford to carry a higher balance, a lower utilization ratio is almost always beneficial for your credit health.

Ignoring credit utilization can have significant negative consequences. A high ratio can lower your credit score, making it harder to get approved for loans, mortgages, or even new credit cards in the future. It can also lead to higher interest rates on future credit applications.

Balance Transfer and Cash Advance

Understanding balance transfers and cash advances is crucial for responsible credit card management. These two features offer distinct functionalities, each carrying its own set of implications.

A balance transfer allows you to move your outstanding balance from one credit card to another. This is often done to take advantage of a lower interest rate offered by a new card, potentially saving you money on interest payments over time. However, it’s important to note that balance transfers usually involve a balance transfer fee, typically a percentage of the transferred amount. Additionally, the introductory low interest rate is often temporary, reverting to a higher standard rate after a promotional period.

A cash advance, on the other hand, lets you withdraw cash from your available credit limit. This can be convenient in emergencies, but it’s generally considered the most expensive way to borrow money. Cash advance fees are usually higher than balance transfer fees, and the interest accrues immediately, without a grace period. Furthermore, the interest rate on a cash advance is often significantly higher than the standard purchase interest rate on your credit card.

Before utilizing either a balance transfer or a cash advance, carefully review the terms and conditions of your credit card agreement. Pay close attention to fees, interest rates, and any associated restrictions. Consider the long-term financial implications and choose the option that best aligns with your budget and financial goals. Improper use of these features can negatively impact your credit score and overall financial health.

Understanding Fees and Charges on Your Statement

Your credit card statement provides a detailed breakdown of all transactions, fees, and charges incurred during the billing cycle. Understanding these entries is crucial for managing your finances effectively and avoiding unexpected costs.

Interest charges are calculated on your outstanding balance if you don’t pay your balance in full by the due date. The Annual Percentage Rate (APR) determines the interest rate applied. Understanding your APR and how it’s calculated is key to minimizing interest payments.

Late payment fees are incurred if your payment arrives after the due date. These fees can significantly impact your overall credit card costs. Always strive to make on-time payments to avoid this charge.

Over-limit fees are applied if your spending exceeds your credit limit. Careful spending habits and monitoring your available credit can help you avoid these fees.

Cash advance fees are assessed when you withdraw cash from an ATM or obtain a cash advance using your credit card. These fees typically include a percentage of the cash advance amount, as well as a higher interest rate than standard purchases.

Foreign transaction fees apply to purchases made in a foreign currency. These fees can add up quickly if you frequently travel internationally. Consider using a credit card that waives or offers lower foreign transaction fees.

Annual fees are yearly membership charges for certain credit cards. Before applying for a credit card, consider whether the benefits offered justify the annual fee.

Regularly reviewing your statement allows you to identify any unrecognizable charges or potentially fraudulent activities promptly. Report any suspicious transactions to your credit card issuer immediately.