Understanding your credit card statement is crucial for responsible credit card management. This seemingly complex document holds the key to monitoring your spending habits, avoiding high interest charges, and maintaining a healthy credit score. This article will dissect the anatomy of a typical credit card statement, explaining each section in detail, empowering you to become a more informed and financially savvy credit card user. We’ll cover everything from understanding your payment due date and minimum payment to deciphering APR (Annual Percentage Rate) and identifying potential errors or fraudulent activity.

From previous balance and new purchases to interest charges and fees, we’ll break down each component of your statement, providing clear explanations and practical tips. Learn how to effectively track your credit utilization rate, a key factor influencing your creditworthiness. Mastering your credit card statement is a fundamental step towards building a strong financial foundation and achieving your long-term financial goals. This guide will provide you with the knowledge and confidence needed to navigate the intricacies of your credit card statements with ease and precision.

What Sections Are Found in Every Statement

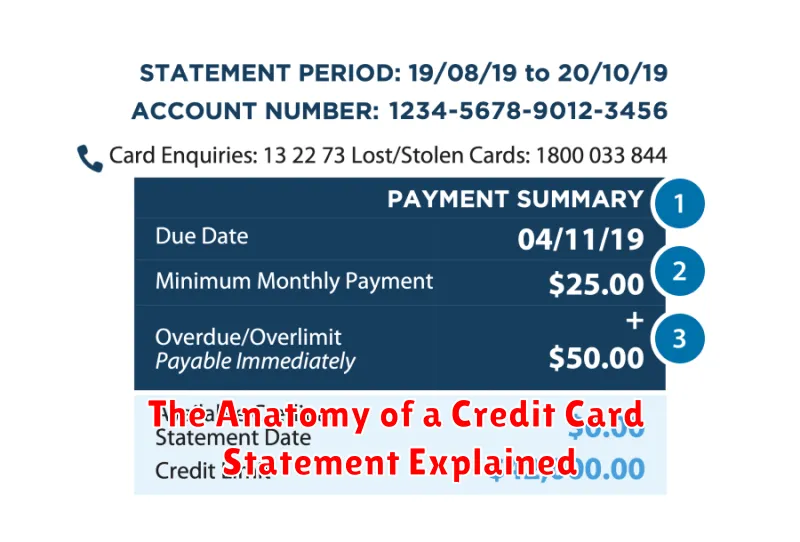

Every credit card statement, regardless of the issuing bank, contains several key sections providing a comprehensive overview of your account activity during a specific billing cycle. Understanding these sections is crucial for effective account management and avoiding potential issues.

Account Information: This section prominently displays your account number, your name, and the billing period covered by the statement. This ensures you’re reviewing the correct account and the transactions for the appropriate time frame.

Previous Balance: This figure reflects the outstanding balance from the previous billing cycle. It’s the starting point for calculating your current balance.

Transactions: This is arguably the most important section. It provides a detailed list of all transactions made during the billing cycle, including the date, merchant, and amount of each purchase, payment, and any fees or credits.

Payments: This section shows all payments you made during the billing cycle, including the date and amount of each payment. This allows you to easily track your payment history.

Fees and Credits: Any fees charged (e.g., late payment fees, over-limit fees) or credits applied (e.g., refunds, promotional credits) during the billing cycle are itemized here.

Interest Charges: If you carry a balance, this section details the interest charges accrued during the billing cycle based on your average daily balance and the applicable interest rate.

Current Balance: This represents your total outstanding balance at the end of the billing cycle. It’s the sum of the previous balance, new purchases, fees, interest, less any payments and credits.

Minimum Payment Due: This shows the minimum amount you are required to pay by the due date to avoid late payment fees. Remember that paying only the minimum payment will prolong the debt and accrue more interest.

Payment Due Date: This indicates the date by which your payment must be received to avoid late fees.

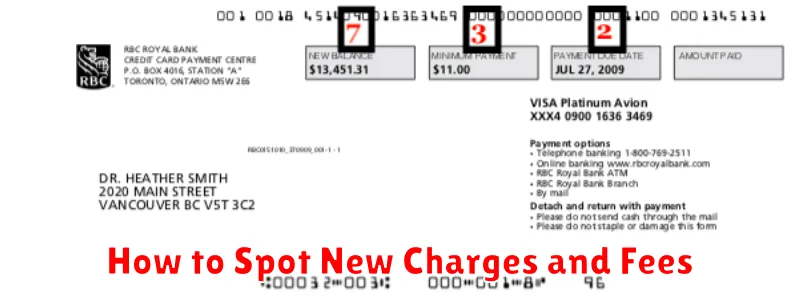

How to Spot New Charges and Fees

Understanding your credit card statement is crucial for managing your finances effectively. One of the most important aspects is identifying new charges and fees. These often appear in a dedicated section, clearly labeled as “Transactions,” “Purchases,” or a similar designation.

Each transaction typically includes key details. Look for the date of the purchase, the merchant’s name, a brief description of the purchase, and the amount charged. Carefully review this information; a quick scan might miss unauthorized transactions or unexpectedly high charges.

Beyond individual transactions, pay close attention to any fees listed separately. Common fees include late payment fees, over-limit fees, balance transfer fees, cash advance fees, and foreign transaction fees. These fees are usually clearly identified and itemized on a separate line or in a dedicated section of the statement. Understanding the terms and conditions of your card is important to avoid unexpected fees.

Recurring charges, such as subscriptions to streaming services or gym memberships, can sometimes be overlooked. Familiarize yourself with your regular subscriptions and compare them against your statement to ensure accuracy and to identify any unauthorized recurring charges.

If you notice any unfamiliar charges or discrepancies between your records and your statement, immediately contact your credit card issuer. Prompt action can prevent potential fraud and help resolve any billing errors. Keeping detailed records of your spending can significantly aid in this process.

Understanding the Minimum Due and Due Date

Your credit card statement contains crucial information regarding your payment obligations. Two key elements are the minimum due and the due date. Understanding these is vital for avoiding late fees and maintaining a healthy credit score.

The minimum due is the smallest amount you can pay to avoid late payment fees. This amount usually covers interest accrued during the billing cycle, plus a small portion of your outstanding balance. It’s important to note that paying only the minimum due will result in carrying a balance and continuing to accrue interest on the remaining amount. This can significantly increase your overall cost over time.

The due date is the date by which your payment must be received by your credit card issuer to avoid late fees. Missing this date, even by a single day, can result in substantial penalties and negatively impact your credit report. It’s crucial to mark this date prominently on your calendar and ensure your payment arrives on or before this date. Consider setting up automatic payments to avoid potential late payment issues.

While paying the minimum due avoids immediate late fees, it’s generally advisable to pay more than the minimum whenever possible. Paying more reduces your outstanding balance, limits the amount of interest charged, and helps you pay off your credit card debt more quickly. Strategic planning and budgeting can help you manage your credit card payments effectively.

How Interest Is Calculated If You Don’t Pay in Full

If you don’t pay your credit card balance in full by the due date, interest will be charged on your outstanding balance. The amount of interest accrued depends on several factors, primarily your credit card’s Annual Percentage Rate (APR) and your payment method.

The APR is the annual interest rate expressed as a percentage. Credit card companies typically use a daily periodic rate, which is calculated by dividing the APR by 365 (or 360, depending on the card issuer). This daily rate is then applied to your average daily balance.

The average daily balance is calculated by adding up the balance of your account each day of the billing cycle and then dividing by the number of days in that cycle. Any payments made during the billing cycle are factored into the daily balance calculation. Therefore, making payments throughout the month can slightly reduce the amount of interest accrued.

Different credit cards may use different methods for calculating your average daily balance. Some may use the previous balance method, which means that interest is calculated based on the balance from the previous billing cycle. Others use the adjusted balance method, which calculates interest based on the balance at the end of the billing cycle. Understanding which method your credit card issuer uses is critical in budgeting for your monthly payments.

The interest calculation is then applied to your outstanding balance. This interest charge will be added to your next statement’s balance, creating a snowball effect if you continue to only pay the minimum amount due.

It’s crucial to carefully review your credit card statement each month to understand the interest calculation and how it impacts your overall debt. Paying more than the minimum amount due will significantly reduce the interest charges and help you pay off your balance more quickly.

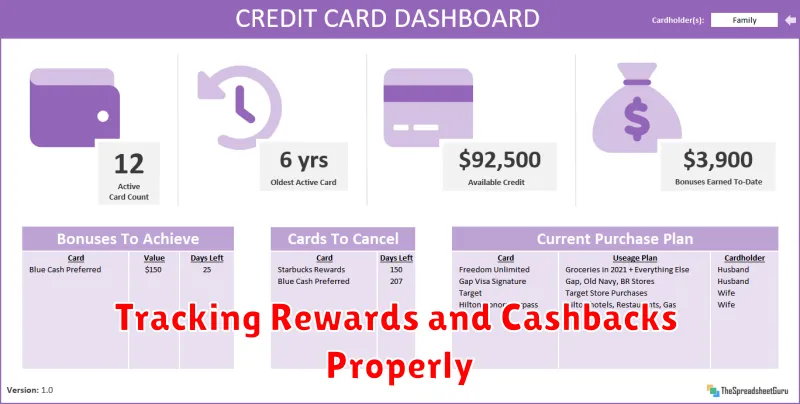

Tracking Rewards and Cashbacks Properly

Understanding your credit card statement requires more than just reviewing your spending; it necessitates diligent tracking of earned rewards and cashbacks. Failing to do so can lead to missed opportunities and a less-than-optimal return on your spending.

Many credit card companies provide online portals where you can monitor your rewards balance. Regularly logging in to check your points, miles, or cash back accumulation is crucial. This allows you to stay informed of your progress toward redemption goals and identify any discrepancies.

Consider using a spreadsheet or a dedicated rewards tracking app to maintain a detailed record of your spending and the corresponding rewards earned. This approach allows for a clearer picture of your return on investment, facilitating informed decisions about future purchases and maximizing your rewards potential. Note the specific transaction, date, amount spent and the reward points/cashback earned.

Pay close attention to expiration dates for rewards and cash back. Many programs have limited validity periods, meaning that accumulated points or cash back may expire if not redeemed within a specified timeframe. Actively managing your rewards helps prevent the loss of these hard-earned benefits.

Familiarize yourself with the terms and conditions of your credit card’s rewards program. Understanding the redemption process, minimum thresholds, and any associated fees will prevent unexpected surprises. The fine print often contains valuable details impacting your rewards’ usability.

Finally, compare different reward programs if you utilize multiple credit cards. This will allow for a holistic view of your total rewards earned across all your cards, providing insights into the best strategies for maximizing your returns. By comparing, you can find the most beneficial card for your spending habits.

What to Do If You Find an Error

Discovering an error on your credit card statement can be frustrating, but knowing how to proceed is crucial to protecting your financial well-being. The first step is to carefully review your statement as soon as you receive it. Pay close attention to each transaction, comparing it to your own records.

If you identify a discrepancy, such as an incorrect amount, a duplicate charge, or a transaction you don’t recognize, don’t panic. Immediately contact your credit card issuer. Most issuers provide a phone number and/or online portal for reporting errors. Keep a record of the date and time you contacted them, as well as the name of the representative you spoke with.

When reporting the error, clearly explain the discrepancy. Provide as much detail as possible, including the date of the transaction, the merchant name, the amount, and any other relevant information. It’s also helpful to have supporting documentation, such as receipts or bank statements, to substantiate your claim.

Under the Fair Credit Billing Act (FCBA), you have specific rights when disputing credit card charges. The FCBA mandates that the issuer investigate your claim within a reasonable timeframe (typically 30-45 days) and notify you of their findings in writing. They are required to correct the error if their investigation confirms your claim.

While waiting for the issuer’s response, keep copies of all correspondence and documentation related to the disputed transaction. This is important for tracking the progress of your claim and for providing evidence if the issue is not resolved satisfactorily. Following these steps will help you effectively address errors and ensure the accuracy of your credit card statement.