Understanding your credit card disclosure statement is crucial for managing your finances effectively. This seemingly complex document holds the key to unlocking valuable information about your credit card interest rates, fees, and other important terms and conditions. By learning how to navigate this important document, you can make informed decisions about your spending habits, avoid unexpected charges, and ultimately, save money. This guide will provide a clear and concise explanation of the key sections within your credit card disclosure, empowering you to become a more savvy consumer.

Many consumers overlook or simply ignore their credit card statements, leading to potential financial pitfalls. However, taking the time to thoroughly review your credit card agreement is an investment in your financial well-being. This article will break down the often-confusing jargon and provide actionable steps to help you understand crucial elements such as Annual Percentage Rate (APR) calculations, grace periods, and late payment fees. Mastering the art of reading your credit card disclosure statement is a fundamental step towards responsible credit card management and achieving long-term financial health.

What Is a Credit Card Disclosure?

A credit card disclosure, also known as a credit card agreement or Truth in Lending Act (TILA) disclosure, is a legally mandated document that provides consumers with essential information about a specific credit card account. This document is crucial for understanding the terms and conditions associated with your credit card, allowing you to make informed financial decisions.

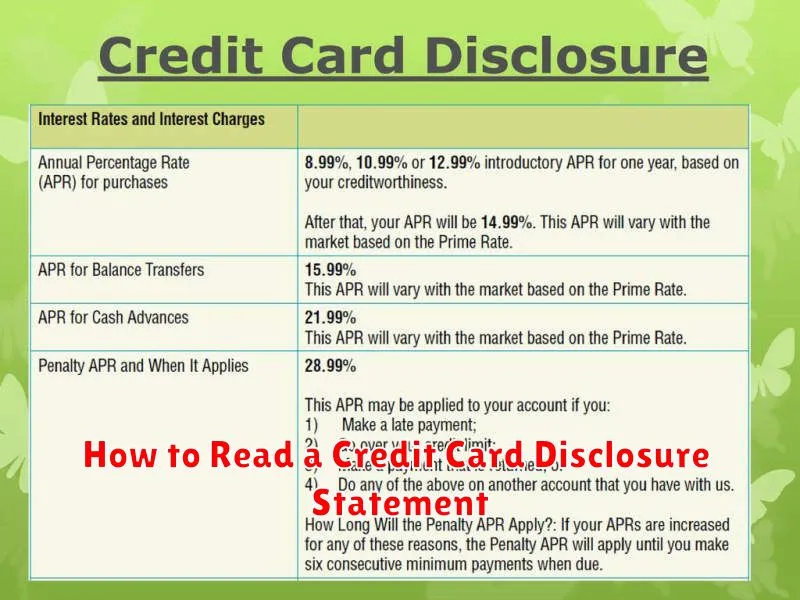

The disclosure outlines various key aspects of the credit card, including but not limited to the Annual Percentage Rate (APR), fees, and other important terms and conditions. The APR represents the annual interest rate charged on outstanding balances. Understanding this rate is paramount in calculating the total cost of using the credit card.

Furthermore, the disclosure details all associated fees, such as annual fees, late payment fees, balance transfer fees, and foreign transaction fees. It’s vital to carefully review these fees to avoid unexpected charges that can impact your finances. The disclosure also clarifies the payment terms, including the minimum payment due, grace period, and methods for making payments.

In essence, a credit card disclosure serves as a comprehensive guide to the specifics of your credit card account, empowering you to make informed choices and manage your credit responsibly. Thoroughly reviewing this document before accepting a credit card is highly recommended.

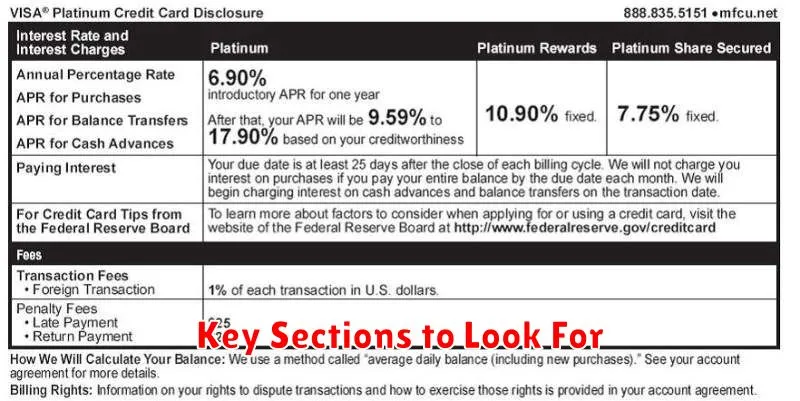

Key Sections to Look For

Understanding your credit card disclosure statement is crucial for managing your finances effectively. To do this, focus on several key sections. These sections provide the essential information you need to make informed decisions about your credit card usage.

First, carefully review the terms and conditions. This section outlines the agreement between you and the credit card issuer. It details the rights and responsibilities of both parties and covers important aspects such as permitted uses of the card, acceptable payment methods, and the consequences of late or missed payments. Pay close attention to any clauses related to fees and interest charges, as these can significantly impact your overall cost.

Next, thoroughly examine the interest rate information. This section will clarify the Annual Percentage Rate (APR), which represents the yearly interest rate charged on outstanding balances. Note that many credit cards have variable APRs, meaning the rate can change over time. Understand how this rate is calculated and any potential factors that could lead to an increase. Also, identify any introductory APR periods, as these often expire, and the rate will adjust upward.

The fees section is another critical area to scrutinize. Credit cards often impose various fees, including annual fees, balance transfer fees, cash advance fees, and late payment fees. Carefully note the amount of each fee, the circumstances under which they apply, and the total potential cost of these fees over time. Understanding these fees will help you manage your spending and avoid unnecessary charges.

Finally, review the payment information section. This outlines the required minimum payment, how to make payments (online, mail, phone), the due date, and the consequences of late or missed payments. Understanding these details will help you avoid late fees and maintain a good credit history.

Understanding Introductory vs Regular APR

A crucial aspect of understanding your credit card disclosure statement is grasping the difference between introductory and regular Annual Percentage Rates (APR). These rates significantly impact the cost of borrowing and should be carefully considered before accepting a credit card offer.

The introductory APR, often significantly lower than the regular APR, is a promotional rate offered for a limited time, typically the first few months or a year of the account. This period serves as an incentive to attract new customers. It’s essential to note the duration of this introductory period, as the rate will revert to the regular APR once it expires. This change can substantially increase your monthly payments if you carry a balance.

The regular APR, on the other hand, is the standard interest rate applied to your balance after the introductory period ends, or if you don’t qualify for the introductory offer. This rate remains consistent unless your creditworthiness changes or the card issuer modifies its interest rate structure. The regular APR is typically higher than the introductory rate and represents the long-term cost of borrowing on the credit card.

Understanding both the introductory and regular APRs allows you to accurately assess the true cost of using the credit card over time. Failing to pay your balance in full each month during the introductory period will result in interest charges at the higher regular APR once the promotional period concludes. Therefore, comparing these rates is vital for making an informed financial decision.

Remember to always carefully review your credit card agreement to understand the specific terms and conditions related to both the introductory and regular APRs, including any potential penalties or fees for late payments or exceeding your credit limit.

Fee Structures and How They Apply

Understanding the fee structure of your credit card is crucial to managing your finances effectively. Credit card companies employ various fee structures, and it’s essential to carefully review them within your disclosure statement.

One common fee is the annual fee, a yearly charge for possessing the card. Not all cards have annual fees; some offer attractive benefits without this cost. The disclosure statement will clearly state whether an annual fee applies and its amount.

Interest charges, also known as finance charges, are the costs associated with borrowing money through credit card purchases. The statement will detail the annual percentage rate (APR), which is the yearly interest rate. This APR can vary based on factors like your creditworthiness and the specific card’s terms. Understanding how interest is calculated (e.g., daily periodic rate) and applied is key to budgeting responsibly.

Transaction fees can also apply. These are usually small fees charged for specific transactions, such as cash advances, balance transfers, or foreign currency transactions. The disclosure statement outlines the specifics of each applicable fee and its associated percentage or fixed amount.

Late payment fees are imposed when payments are not made by the due date. The amount of this fee is usually specified in the disclosure statement. It’s important to note the due date and to make payments on time to avoid these charges.

Over-limit fees might be assessed if your spending exceeds your credit limit. The credit card agreement clearly defines the conditions under which over-limit fees may apply and the amount that will be charged.

Reviewing the fee schedule within your credit card disclosure statement diligently will help you understand and manage all potential charges associated with your account, ensuring you have a clear picture of your financial obligations.

Reading the Fine Print on Penalties

Understanding the penalty fees associated with your credit card is crucial to managing your finances effectively. These fees can significantly impact your overall cost of borrowing and should be carefully reviewed before you accept the terms of your credit card agreement.

Late payment fees are perhaps the most common penalty. The disclosure statement will clearly specify the amount of this fee. Be aware that some issuers may charge a higher fee if you have multiple late payments within a certain period. It’s vital to understand these late fee structures to avoid unexpected charges.

Beyond late payments, over-limit fees are another significant penalty. If your spending exceeds your credit limit, you’ll likely incur a fee. The disclosure statement will outline the amount of this fee and the circumstances under which it applies. Careful budgeting and tracking of spending are essential to avoid these charges.

Returned payment fees occur when a payment you’ve submitted is rejected, usually due to insufficient funds. This fee can be substantial, and it’s important to understand the conditions for incurring this penalty. Ensure you have sufficient funds in your account before making a payment to avoid this charge.

Cash advance fees are charges associated with withdrawing cash from your credit card. These fees are usually a percentage of the amount withdrawn, plus an additional interest rate that often starts accruing immediately. The disclosure will specify the applicable percentage and interest rate for cash advances.

Finally, carefully read the statement to understand any foreign transaction fees. These fees are typically a percentage of each transaction made in a foreign currency. If you plan on using your card internationally, this is a particularly important detail to consider.

Why Reviewing Disclosure Saves You Money

Understanding your credit card disclosure statement is crucial for managing your finances effectively. A thorough review can prevent unexpected fees and help you choose the most cost-effective card for your needs.

By carefully examining the Annual Percentage Rate (APR), you can compare interest rates across different cards and select the one with the lowest rate. This directly impacts the amount of interest you pay over time, potentially saving you a significant sum.

The disclosure statement details all fees associated with your card, including annual fees, balance transfer fees, cash advance fees, and late payment fees. Knowing these fees upfront allows you to budget accordingly and avoid incurring unnecessary charges. Failing to review these fees can lead to substantial unforeseen expenses.

Analyzing the grace period information helps you understand how long you have to pay your balance in full to avoid interest charges. Utilizing the grace period effectively can save you considerable interest payments throughout the year.

Furthermore, understanding the payment calculation methods helps you accurately track your payments and minimize interest accrual. A clear understanding of how your payment is applied to your balance prevents unexpected surprises and helps optimize your repayment strategy.

Finally, reviewing your statement regularly allows you to promptly identify and address any errors or discrepancies. Addressing these issues promptly prevents them from accumulating and negatively impacting your credit score and overall financial health. Catching these errors early on is a key way to save money and avoid unnecessary stress.