Securing a business loan can be a pivotal moment for your company’s growth, offering access to crucial capital for expansion, equipment purchases, or navigating challenging financial periods. However, before you sign on the dotted line, it’s imperative to fully understand the intricate details of the loan terms. Navigating the complexities of interest rates, repayment schedules, and various fees is crucial to making an informed decision that aligns with your financial goals and avoids potential pitfalls. This article will demystify key business loan terms, empowering you to confidently negotiate and secure the best possible financing for your enterprise.

Understanding the nuances of business loan agreements is paramount to ensuring long-term financial health. Failing to grasp crucial terms and conditions can lead to unforeseen financial burdens, jeopardizing your company’s stability. We’ll break down essential concepts such as loan amortization, collateral requirements, and the implications of different loan types, including term loans, lines of credit, and SBA loans. By equipping yourself with this knowledge, you can confidently approach lenders, negotiate favorable loan agreements, and ultimately, position your business for sustained success.

APR vs Interest Rate in Business Lending

Understanding the difference between Annual Percentage Rate (APR) and the interest rate is crucial when securing business financing. While often used interchangeably, they represent distinct aspects of your loan’s cost.

The interest rate is the percentage charged on the principal loan amount. It’s a fundamental component of your loan’s cost but doesn’t capture the entire picture. It reflects the pure cost of borrowing the money.

The APR, on the other hand, provides a more comprehensive representation of the total cost of borrowing. It encompasses the interest rate plus all other fees associated with the loan, such as origination fees, closing costs, and any other charges. These additional fees are expressed as a percentage of the loan amount and are added to the interest rate to arrive at the APR.

Therefore, the APR offers a clearer, more accurate picture of your overall borrowing costs. It allows for a more straightforward comparison between different loan offers, even if they have the same stated interest rate but differing fees. A lower APR generally indicates a better deal, as it suggests lower overall borrowing costs.

Always review both the interest rate and the APR carefully before committing to a business loan. Comparing these two figures will help you make an informed decision that best suits your financial needs and minimizes the total cost of borrowing.

Balloon Payments and What They Mean

A balloon payment is a large, lump-sum payment due at the end of a loan term. Unlike loans with amortized payments where the principal and interest are paid off gradually over the loan’s life, a balloon payment requires a significant final payment to fully settle the debt.

These loans are structured so that the borrower makes smaller, more manageable monthly payments for a set period. However, this lower monthly payment comes at a cost. The remaining principal balance is deferred until the maturity date, resulting in that substantial balloon payment.

The size of the balloon payment depends on several factors including the loan amount, the interest rate, and the loan term. A shorter loan term typically results in a larger balloon payment because less of the principal is repaid during the regular payment period.

Understanding the implications of a balloon payment is crucial before signing a loan agreement. Borrowers need to realistically assess their financial capacity to make this substantial final payment. Failure to meet this obligation can lead to serious consequences, including default and potential damage to credit scores.

Balloon payments are often found in commercial real estate loans and certain types of business financing. They can offer advantages, such as lower monthly payments in the early stages, but they inherently carry a higher level of risk. Careful planning and a clear understanding of your financial projections are essential before considering a loan with a balloon payment.

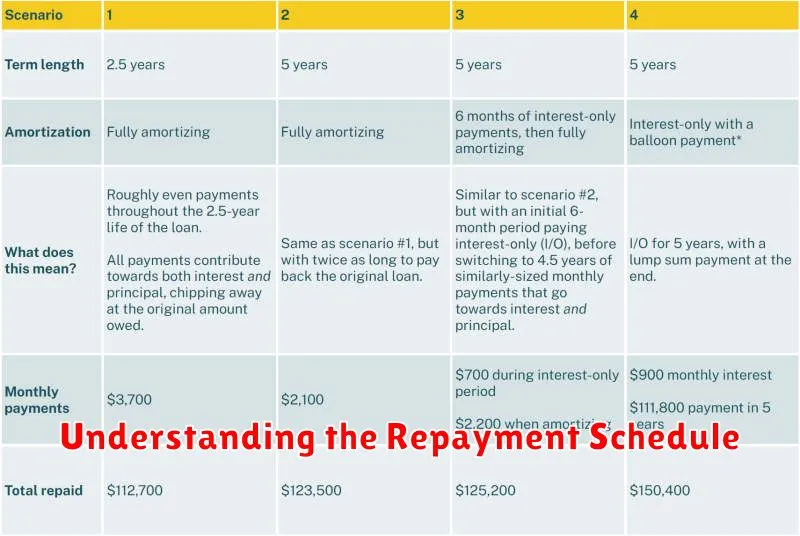

Understanding the Repayment Schedule

A crucial aspect of any business loan is the repayment schedule. This schedule outlines the specific dates and amounts of your payments over the loan’s term. Understanding this schedule is vital for effective budgeting and financial planning.

Loan term, the total time you have to repay the loan, directly impacts the repayment schedule. A shorter term will result in higher monthly payments, while a longer term will mean lower monthly payments but higher overall interest costs. Carefully weigh the implications of each to determine the best fit for your business’s cash flow.

The payment frequency is another important element. Most business loans offer monthly payments, but some may allow for quarterly or even semi-annual payments. Choosing a frequency that aligns with your business’s income cycle is crucial for managing your finances effectively. Remember to consider how payment frequency affects your total interest paid.

Amortization is how your payments are structured. In a typical amortized loan, each payment includes both principal (the original loan amount) and interest. Early payments consist primarily of interest, with the principal portion gradually increasing over time. Reviewing your amortization schedule helps you track your loan’s progress and understand how much of your payments are allocated to reducing the principal balance.

Before signing any loan agreement, it is essential to thoroughly review the provided repayment schedule. Confirm that the payment amounts, frequencies, and total interest charges are clearly outlined and align with your financial expectations and capabilities. If anything is unclear, seek clarification from the lender before proceeding.

Prepayment Penalties and Flexibility

Understanding prepayment penalties is crucial when considering a business loan. Many loans include clauses specifying penalties for paying off the loan early. These penalties can vary significantly, from a small percentage of the remaining balance to a substantial amount, potentially negating any financial benefit of early repayment.

The structure of the penalty can also differ. Some loans may charge a flat fee, while others calculate the penalty based on the outstanding principal or the remaining interest. Carefully review the loan agreement to understand the precise terms and conditions related to prepayment penalties.

Flexibility in repayment terms is another critical factor. A loan with inflexible terms, such as strict prepayment penalties, can restrict your financial maneuverability. Consider the potential impact on your cash flow and ability to adapt to unexpected financial circumstances. A loan with more flexibility allows you to adjust your repayment schedule as needed, potentially saving you money in the long run or helping to manage unforeseen events.

Before signing any business loan agreement, thoroughly examine the provisions regarding early repayment. Compare offers from different lenders to identify loans that offer favorable terms and minimize the potential financial burden of prepayment penalties. Understanding these terms will empower you to make informed decisions that benefit your business.

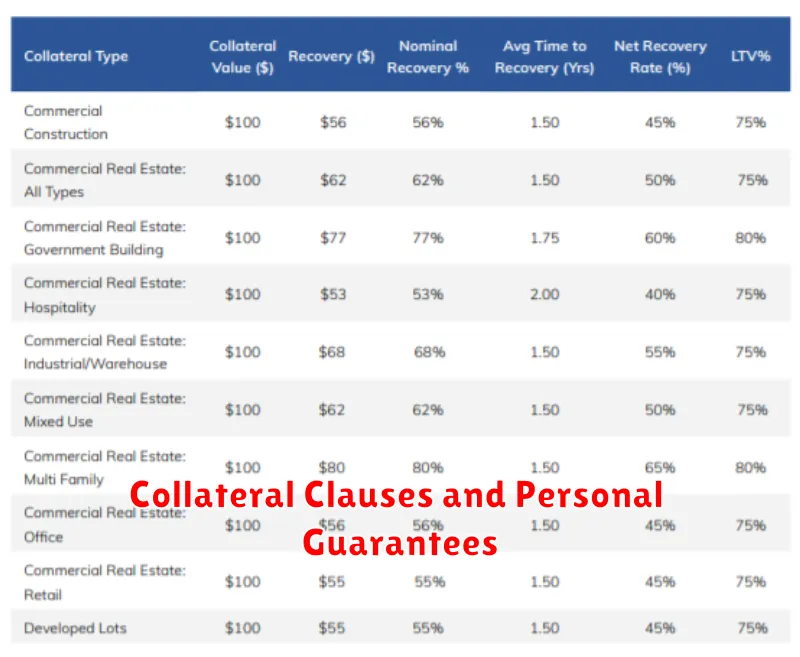

Collateral Clauses and Personal Guarantees

Before signing a business loan agreement, it’s crucial to understand the terms related to collateral clauses and personal guarantees. These clauses significantly impact your liability in case of loan default.

A collateral clause specifies the assets you pledge as security for the loan. If you fail to repay the loan, the lender has the right to seize and sell these assets to recover their losses. Examples of collateral might include real estate, equipment, inventory, or accounts receivable. Carefully review the list of assets included in the collateral clause and ensure you are comfortable with the potential consequences of default.

A personal guarantee, often requested by lenders for smaller businesses or those with limited assets, holds you personally liable for the loan. This means that if your business fails to repay the loan, the lender can pursue your personal assets, including your savings, investments, and even your home, to recover the debt. This can have severe financial repercussions, potentially leading to bankruptcy. Understand the full implications of signing a personal guarantee and seek legal advice if you have any concerns.

The strength of the collateral and the presence of a personal guarantee directly influence the lender’s risk assessment and, consequently, the loan’s terms, including the interest rate. A stronger collateral position or a personal guarantee can often secure more favorable loan terms. However, it’s essential to weigh these benefits against the potential risks involved.

Negotiating these clauses is possible, although the extent of negotiation depends on your bargaining power and the lender’s risk appetite. You might be able to negotiate the type and amount of collateral or explore alternatives to a personal guarantee, such as a limited liability guarantee. Always seek professional financial and legal advice before agreeing to any loan terms.

Where to Find Key Terms in Your Contract

Understanding your business loan contract is crucial before signing. Locating and comprehending key terms within the document can prevent future misunderstandings and potential financial difficulties. These terms are often buried within dense legal jargon, making it challenging to find them.

Definitions sections are a prime location to start your search. Many contracts include a dedicated section upfront that defines key terminology used throughout the agreement. This is usually titled “Definitions,” “Key Terms,” or something similar. Look for definitions of terms like interest rate, loan amount, repayment schedule, collateral, and any other terms unique to your loan.

The principal terms of the loan are generally found within the main body of the contract. This area will typically detail the loan amount, the interest rate (which might be a fixed or variable rate), the repayment period, and any associated fees or charges. Pay close attention to how these terms are calculated and expressed.

Sections relating to prepayment penalties, default provisions, and late payment fees are equally important. These sections outline the consequences of not adhering to the terms of the loan agreement. Understanding these clauses will help you avoid unexpected costs and protect your business.

Finally, don’t overlook the governing law clause, which specifies which state’s laws govern the contract. This is vital as different states have different laws regarding business loans and debt collection.

If you are having difficulty locating or understanding these key terms, consider seeking professional legal advice. A lawyer can help you navigate the legal jargon and ensure you fully understand your obligations and rights under the contract.