Securing a business loan can be a pivotal moment for any entrepreneur, providing the crucial funding needed for expansion, innovation, or navigating challenging economic periods. However, the loan approval process can be daunting, with many applications facing rejection. This comprehensive guide, “How to Improve Business Loan Approval Chances,” will equip you with the knowledge and strategies to significantly increase your likelihood of securing the financing you need. We’ll delve into essential aspects, from crafting a compelling business plan and demonstrating strong financial health to understanding lender requirements and navigating the complexities of the application process.

Understanding the intricacies of small business loans and the factors that influence lender decisions is paramount. This article will provide a clear roadmap to navigate the challenges and maximize your chances of approval. Learn how to present a robust financial projection, showcase your creditworthiness, and effectively communicate your business’s potential to lenders. We’ll cover various types of loans available, helping you choose the best fit for your specific business needs, and provide practical tips for preparing a winning loan application.

Strengthen Your Business Credit Report

A strong business credit report is paramount to securing favorable loan terms. Lenders heavily rely on this report to assess your business’s creditworthiness and risk profile. Improving your business credit report demonstrates financial responsibility and increases your chances of loan approval.

One crucial step is to establish business credit separately from your personal credit. This means obtaining an Employer Identification Number (EIN) from the IRS and using it to open business credit accounts. Keep in mind that while your personal credit score might influence initial loan applications, building a distinct business credit history is essential for long-term success.

Pay all your business bills on time. This is perhaps the single most important factor influencing your business credit score. Late payments severely damage your creditworthiness and can significantly hinder your loan application process. Set up automated payments to avoid late fees and maintain a consistent payment record.

Maintain a low business credit utilization ratio. Similar to personal credit, keeping your business credit utilization low – ideally under 30% – shows responsible credit management. This demonstrates that you are not overextending your business’s finances and are able to handle existing debts effectively.

Monitor your business credit report regularly. Regularly reviewing your report from major business credit bureaus like Experian, Equifax, and Dun & Bradstreet allows you to identify and address any inaccuracies or negative entries promptly. Early detection and correction of errors can significantly improve your credit score over time.

Consider obtaining trade credit. Establishing trade credit with suppliers by paying invoices on time can positively impact your credit score. Positive payment history from these accounts demonstrates reliability and strengthens your credit profile.

Establish a consistent business banking relationship. Maintaining a healthy bank account and building a relationship with your bank can greatly benefit your loan application. A positive banking history showcases responsible financial management, increasing your chances of approval.

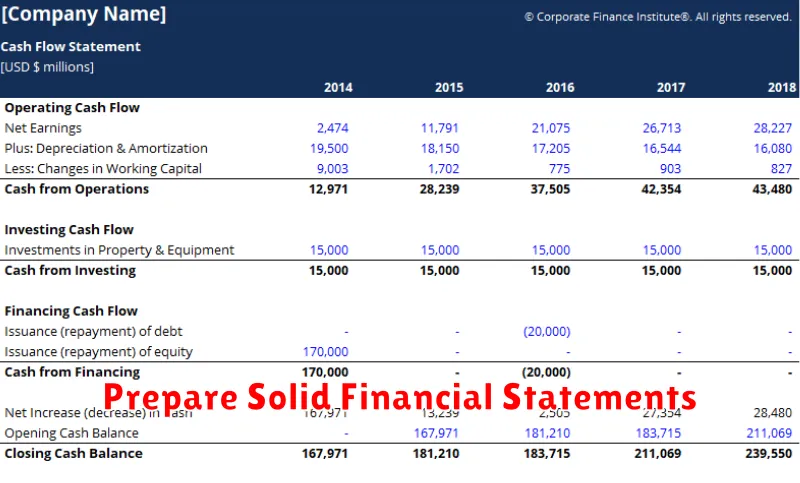

Prepare Solid Financial Statements

Securing a business loan hinges significantly on the strength of your financial statements. Lenders rely heavily on these documents to assess your business’s financial health and your ability to repay the loan. Therefore, preparing accurate and comprehensive financial statements is paramount.

Ensure your balance sheet accurately reflects your assets, liabilities, and equity. This provides a snapshot of your business’s financial position at a specific point in time. Similarly, your income statement, also known as a profit and loss statement, should clearly illustrate your revenues, expenses, and net income or loss over a specific period. This demonstrates your profitability and cash flow generation capabilities. The cash flow statement is equally crucial, detailing the movement of cash into and out of your business, highlighting your ability to meet your financial obligations.

These statements must be up-to-date and cover a sufficient period, typically the last two to three years. Inconsistent or incomplete records can raise red flags for lenders, leading to loan rejection. Consider engaging a qualified accountant to prepare or review your statements, ensuring accuracy and adherence to accounting standards. This professional assistance can significantly improve the credibility and trustworthiness of your financial presentation.

Beyond the core statements, lenders may also request additional supporting documentation, such as tax returns and bank statements. Having these readily available demonstrates your preparedness and transparency. A well-organized and easily understandable presentation of your financials will significantly enhance your chances of loan approval.

Have a Clear Repayment Strategy

Lenders are primarily concerned with repayment ability. A well-defined repayment strategy demonstrates your commitment to repaying the loan and significantly improves your chances of approval.

Your strategy should detail how you plan to generate the revenue needed to cover loan installments. This might include projecting future sales, outlining cost-cutting measures, or detailing plans for increased efficiency. Be specific and realistic in your projections.

Clearly outline your projected cash flow, showing how your business will manage the loan payments alongside other operational expenses. Include a realistic timeline for repayment, avoiding overly optimistic projections.

Consider different repayment scenarios to showcase your preparedness for potential financial downturns. This could involve outlining contingency plans for handling unexpected expenses or decreased revenue.

Provide detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements. These documents provide concrete evidence supporting your repayment plan and strengthen your application.

A transparent and well-articulated repayment strategy instills confidence in lenders, making them more comfortable with approving your loan request. This is a crucial element in securing the financing you need for your business.

Ensure Legal and Tax Filings Are in Order

Maintaining accurate and up-to-date legal and tax filings is crucial for securing a business loan. Lenders meticulously review these documents to assess the financial health and stability of your business. Incomplete or inaccurate filings can raise serious red flags and significantly reduce your chances of approval.

Ensure all necessary business licenses and permits are current. This demonstrates your commitment to operating legally and responsibly. Missing or expired licenses can indicate a lack of organizational skills and potentially legal issues, impacting lender confidence.

Your tax returns must be meticulously prepared and filed on time. Lenders will thoroughly examine your tax history to evaluate profitability, consistency of revenue, and adherence to tax regulations. Consistent profitability and timely tax filings significantly enhance your credibility.

Accurate and complete financial statements are also essential. These should align with your tax filings and provide a clear picture of your business’s financial position. Discrepancies between tax returns and financial statements are a major cause for concern and may lead to loan rejection.

Consider seeking professional assistance from an accountant or legal professional. They can ensure all your filings are accurate, complete, and compliant with all relevant regulations. This professional guidance minimizes the risk of errors and significantly improves your chances of loan approval.

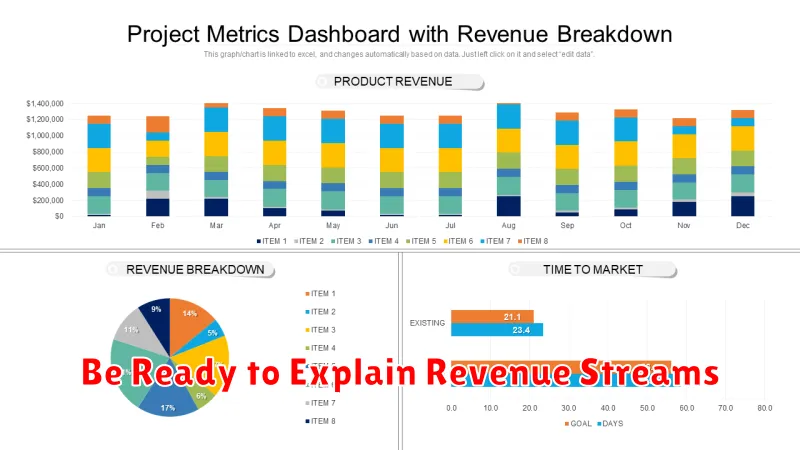

Be Ready to Explain Revenue Streams

Lenders want to understand how your business makes money and the stability of your income. A clear and concise explanation of your revenue streams is crucial for a successful loan application. Be prepared to detail each source of income, providing specific examples and quantifiable data.

This includes outlining your primary revenue sources and any secondary streams that contribute to your overall financial health. For instance, if you sell products online and also offer in-person consultations, both should be clearly delineated and quantified. The more detail you provide, the better the lender can assess the viability and sustainability of your business.

Historical data is key. Present your revenue figures from previous years, demonstrating growth trends and highlighting any seasonal fluctuations. This allows the lender to see a clear picture of your financial performance and predict future revenue. Remember to be upfront about any challenges or dips in revenue, explaining the circumstances and the steps taken to address them. Transparency is crucial here.

Moreover, you should illustrate your understanding of future revenue projections. Support these projections with sound reasoning, based on market analysis, sales forecasts, or other relevant data. Demonstrating a proactive and well-informed approach to your financial planning will significantly enhance your credibility and increase your chances of loan approval. This demonstrates your preparedness and business acumen.

Finally, be ready to discuss the diversity of your revenue streams. A business with multiple revenue streams is generally viewed as less risky. A well-diversified business is better positioned to weather economic downturns and unexpected challenges.

Choose the Right Loan Type for Your Business Model

Selecting the appropriate loan type is crucial for increasing your chances of business loan approval. Different loans cater to various business needs and financial situations. Understanding these nuances is key to a successful application.

Term loans, for instance, offer a fixed amount of money repaid over a set period with fixed monthly payments. These are ideal for long-term investments like purchasing equipment or expanding facilities. The predictability of payments makes them attractive to lenders, but they may not be suitable for businesses with fluctuating cash flow.

Lines of credit provide a flexible source of funding you can draw upon as needed, up to a pre-approved limit. This is beneficial for businesses facing unpredictable expenses or needing working capital for seasonal fluctuations. However, interest is typically only charged on the amount borrowed, and the approval process might be more stringent.

Small Business Administration (SBA) loans are government-backed loans that often come with more favorable terms, including lower interest rates and longer repayment periods. While they require a more rigorous application process, their advantages can significantly improve your chances of approval, especially for startups or businesses with less-than-perfect credit.

Invoice financing uses outstanding invoices as collateral, providing immediate cash flow. This option suits businesses with a steady stream of invoices but requires sufficient creditworthiness and invoice volume. It’s a short-term solution, not a long-term financing strategy.

Merchant cash advances provide a lump sum based on your credit card sales, with repayment linked to future sales. These are often high-cost options and may not be suitable for all business models; understanding the repayment terms is essential.

Before applying for any loan, carefully consider your business’s financial health, cash flow projections, and long-term goals. Matching your business model to the right loan type greatly improves your prospects for a successful application and securing the necessary funding.