Facing the daunting task of student loan repayment? Understanding the intricacies of your student loan debt is crucial to avoid financial hardship. This is where student loan exit counseling becomes indispensable. This essential process, often mandated upon graduation, provides graduating students with invaluable information and resources to navigate the complexities of repayment and make informed decisions regarding their federal student loans. Failing to complete exit counseling can have serious consequences, impacting your credit score and overall financial well-being. Learn why participating in this mandatory counseling is a vital step towards responsible debt management.

Student loan exit counseling offers a comprehensive overview of various repayment plans, including income-driven repayment options and the potential benefits of loan consolidation. It empowers borrowers to understand their repayment responsibilities, explore available deferment and forbearance options, and access resources to address potential financial challenges. By attending this required counseling session, you gain a crucial understanding of your student loan repayment options, paving the way for a smoother transition into post-graduate life and a more secure financial future. Don’t underestimate the importance of this crucial step – your future financial stability depends on it.

What Is Exit Counseling and Who Needs It

Exit counseling is a required process for students who are leaving college or graduate school before completing their degree program or are otherwise no longer enrolled. It’s designed to help students understand their student loan repayment options and responsibilities.

Essentially, exit counseling provides a comprehensive overview of the student’s loan situation, including the total amount borrowed, the types of loans they have (federal or private), and their repayment terms. It helps them prepare for the transition from student to borrower, arming them with the knowledge they need to manage their debt effectively.

Who needs exit counseling? The requirement applies to almost all students who have received federal student loans. This includes students who withdraw from school, graduate, or complete their program of study. There may be exceptions depending on the specific lender or loan program, so it’s crucial to check with your school’s financial aid office for clarification.

While the specifics of exit counseling may vary, it typically involves reviewing your loan information, exploring repayment plans, and understanding your rights and responsibilities as a borrower. This often includes information on deferment and forbearance options, as well as resources for managing student loan debt.

Failing to complete exit counseling can have consequences. It might delay the disbursement of your loans or even impact your credit score. Therefore, attending your exit counseling session is a crucial step in responsibly managing your student loans.

What You’ll Learn During Exit Counseling

Exit counseling is a crucial step for graduating students with federal student loans. During this session, you’ll receive important information to help you manage your loans effectively after you leave school.

Understanding your loan repayment options is a key component. You’ll learn about the various repayment plans available, including standard, extended, graduated, and income-driven repayment plans. Each plan has different terms and implications for your monthly payments and overall repayment period, so understanding these differences is essential.

You’ll also gain knowledge about interest capitalization, which is when unpaid interest is added to your principal loan balance. This can significantly impact your overall loan cost. Understanding how interest capitalization works and how to minimize its effect is vital for long-term financial health.

The session covers managing your loan account, including how to make payments, update your contact information, and understand what to do in the event of financial hardship. Knowing how to effectively communicate with your loan servicer is paramount.

Finally, exit counseling provides an opportunity to ask questions. You should take advantage of this chance to clarify any doubts about your repayment responsibilities and explore resources available to help you succeed in managing your student loan debt.

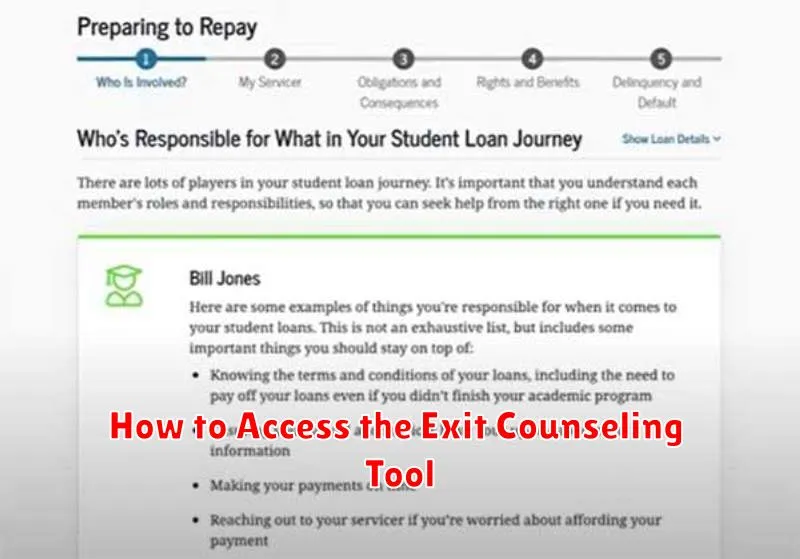

How to Access the Exit Counseling Tool

Accessing your exit counseling tool is a crucial step in managing your student loans after graduation. The process varies slightly depending on your loan servicer, but generally involves a few straightforward steps.

First, you’ll need to locate your loan servicer’s website. Your servicer’s contact information should be available on your student loan statements or through the National Student Loan Data System (NSLDS).

Once on your servicer’s website, look for a section dedicated to “exit counseling,” “loan repayment,” or a similar phrase. Many servicers prominently feature this information on their homepage or within a dedicated “Borrowers” section.

You will likely be required to log in to your account using your assigned username and password. If you’ve forgotten your login details, most servicers provide a password reset option.

After logging in, navigate to the exit counseling section. You’ll find a tool or link to initiate the process. The tool will typically guide you through a series of screens providing important information regarding your loan repayment options, interest rates, and repayment schedules. Pay close attention to this information, as it directly impacts your financial future.

Remember to complete the exit counseling process before your loans enter repayment. Failing to do so may have consequences, so timely completion is essential. If you experience any difficulties, contact your loan servicer directly for assistance.

Understanding Your Repayment Options

Exiting student loan repayment counseling isn’t just about completing a requirement; it’s a crucial step in understanding your options and developing a sustainable repayment strategy. Choosing the right repayment plan is vital to managing your debt effectively and avoiding potential financial hardship.

Several repayment plans exist, each with its own set of terms and conditions. These plans differ in their monthly payment amounts, the total amount of interest paid over the life of the loan, and the loan repayment period. Standard repayment plans typically involve fixed monthly payments over a 10-year period. However, this might result in higher monthly payments.

Income-driven repayment (IDR) plans offer lower monthly payments based on your income and family size. These plans can significantly reduce your monthly burden, but they generally extend the repayment period, leading to a higher total interest paid over time. Extended repayment plans offer a longer repayment period than standard plans, reducing monthly payments but increasing total interest paid.

Before deciding, carefully weigh the pros and cons of each plan. Consider your current financial situation, your anticipated future income, and your long-term financial goals. Seeking professional financial advice is often recommended to make an informed decision that aligns with your individual circumstances. Understanding these options and their implications is a critical component of responsible student loan management.

Remember that your repayment plan can be changed under certain circumstances. Life events such as job loss or a change in family size may necessitate a reassessment of your repayment plan. Your loan servicer can help you explore options for modifying your plan to better suit your financial reality.

Tracking Loan Servicers and Balances

Effectively managing your student loans requires diligent tracking of your loan servicers and outstanding balances. This is crucial for ensuring timely payments and avoiding potential issues.

Multiple loan servicers may manage your federal student loans. Each servicer will have its own online portal and contact information. Keeping track of which servicer is responsible for each loan is paramount to making payments accurately and efficiently. Misdirecting a payment can lead to late fees and negative impacts on your credit score.

Regularly checking your loan balance is equally important. Understanding your current balance helps you budget effectively and stay on track towards loan repayment. You can usually access this information through your servicer’s online portal or by contacting them directly. This consistent monitoring prevents surprises and unexpected debt increases.

Utilizing tools like federal student aid websites, and your servicer’s online portals aids in centralizing this information. By carefully organizing this data, you maintain clarity and efficiency in managing your student loan repayment.

Furthermore, keeping detailed records, including payment confirmations and statements, can be invaluable for future reference and dispute resolution. These documents provide irrefutable proof of payments made and help prevent future discrepancies. Maintaining organized records also simplifies the process of tracking your progress toward loan payoff.

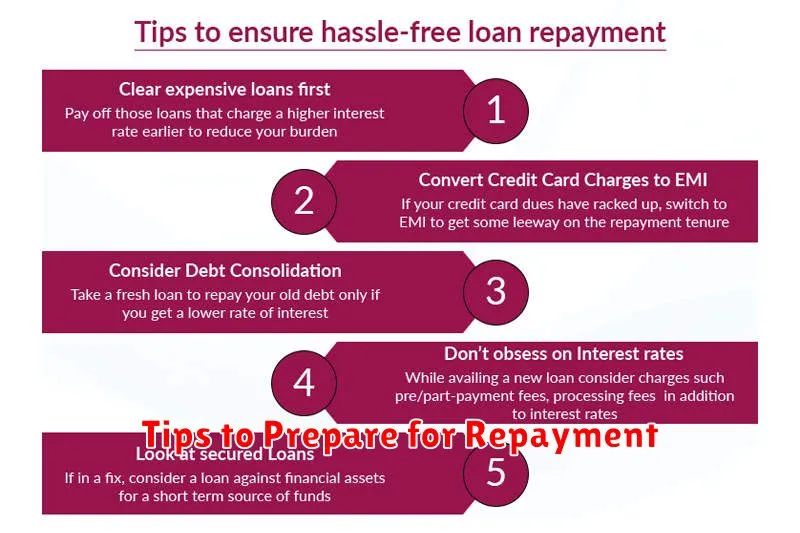

Tips to Prepare for Repayment

Before your grace period ends, actively prepare for student loan repayment. This involves understanding your loan details, including the total amount owed, the interest rate, and the repayment plan you’ve chosen.

Create a realistic budget that incorporates your monthly loan payments. Track your income and expenses to ensure you can comfortably afford your payments without compromising your other financial obligations. Consider using budgeting apps or spreadsheets to aid in this process.

Explore different repayment plans offered by your loan servicer. Understanding the pros and cons of each plan – such as standard, graduated, extended, or income-driven repayment – will help you select the option that best aligns with your financial situation and long-term goals.

Automate your payments to avoid late fees and ensure consistent repayment. Setting up automatic payments is a simple yet effective way to manage your student loans and prevent missed payments.

Communicate with your loan servicer proactively. If you anticipate difficulty making payments, contact your servicer immediately to explore options like deferment or forbearance. Early communication can prevent negative impacts on your credit score.

Finally, consider exploring additional income sources to help accelerate your repayment process. This might involve seeking a higher-paying job, taking on a side hustle, or adjusting your spending habits to free up additional funds for loan payments.