Managing your student loan debt while navigating the demands of higher education can feel overwhelming. However, proactive student loan tracking is crucial to avoid future financial difficulties and ensure you’re on the path to successful repayment. This guide provides a comprehensive overview of effective strategies for monitoring your student loan balances, understanding your loan terms, and preparing for the transition into repayment. Learning how to effectively track your loans now will empower you to make informed financial decisions throughout your academic journey and beyond, setting you up for long-term financial health.

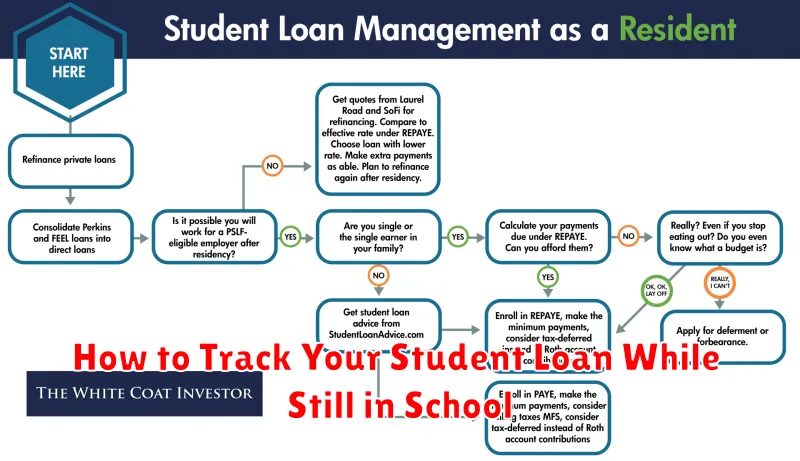

Understanding your student loan servicer, interest rates, and repayment plans are key components of effective student loan management. This article will equip you with the knowledge and tools necessary to confidently track your progress, explore potential deferment or forbearance options if needed, and build a solid foundation for successful debt repayment after graduation. Whether you have federal student loans or private student loans, mastering these strategies will significantly reduce stress and help you gain control over your financial future.

Why You Should Know Your Loan Balance Early

Knowing your student loan balance early on offers several significant advantages during your time in school and beyond. It provides a clearer understanding of your financial obligations, enabling proactive financial planning.

Budgeting becomes significantly easier when you’re aware of the total amount you’ll need to repay. This allows you to create a realistic budget that incorporates loan repayments, alongside other expenses like tuition, living costs, and personal spending. This early awareness helps avoid the shock of a large debt upon graduation.

Early awareness of your loan balance also facilitates exploration of potential repayment options. Understanding your loan amount allows you to investigate different repayment plans, including income-driven repayment or deferment options, which might better suit your financial circumstances after graduation.

Furthermore, tracking your loan balance early can help you identify and address any potential errors or discrepancies in your loan information. Catching and correcting these issues early minimizes potential problems later on, such as incorrect interest accrual or reporting inaccuracies.

Finally, a solid understanding of your loan balance from the outset fosters a sense of financial responsibility. It helps cultivate good financial habits, essential for successful debt management throughout your life.

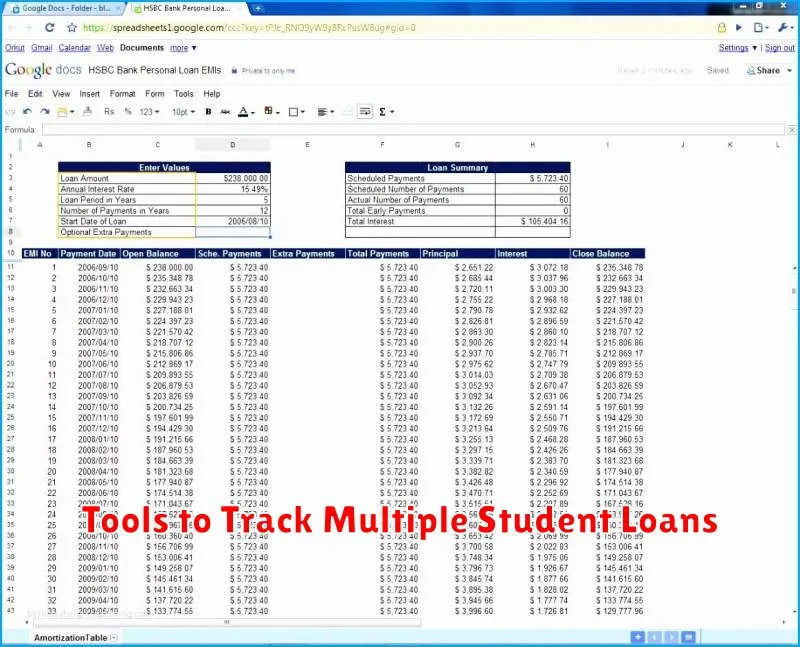

Tools to Track Multiple Student Loans

Managing multiple student loans can feel overwhelming, especially while juggling the demands of school. Fortunately, several tools can simplify the process and help you stay organized. Effective tracking is key to avoiding late payments and understanding your overall debt.

One popular option is using a spreadsheet program like Microsoft Excel or Google Sheets. You can create a customized spreadsheet to list each loan, including the lender, loan amount, interest rate, minimum payment, due date, and payment history. This provides a clear overview of your debt and allows for easy tracking of payments and balances. The flexibility of spreadsheets allows for personalized organization based on your specific needs.

Alternatively, numerous dedicated student loan tracking websites and apps are available. Many offer features beyond basic tracking, including payment reminders, amortization schedules, and the ability to link directly to your loan accounts. Some even provide tools to compare repayment plans and explore refinancing options. Before selecting a platform, carefully review its features and security measures to ensure it aligns with your needs and protects your sensitive financial data.

Finally, consider leveraging the online portals provided by your individual lenders. Most lenders offer online access to your loan accounts, providing up-to-date information on balances, payment history, and upcoming due dates. While this approach requires logging into multiple accounts, it offers a direct and reliable way to track your loans from the source.

The best tool for you will depend on your personal preferences and the number and complexity of your loans. Experiment with different methods to find the one that best suits your needs and helps you maintain a clear picture of your student loan finances.

Understanding Interest Accrual During School

While in school, the interest on your student loans may still accrue, depending on the type of loan you have. Understanding how this works is crucial to managing your debt effectively.

Subsidized federal loans typically do not accrue interest while you are enrolled at least half-time in an eligible degree or certificate program. This means the government pays the interest during this grace period. However, once you leave school or drop below half-time enrollment, interest will begin to accrue.

Unsubsidized federal loans and most private student loans, on the other hand, accrue interest from the moment the loan is disbursed. This means the interest is added to your principal balance, increasing the total amount you owe over time. Even while you’re still in school, the interest is accumulating, leading to a larger loan balance upon graduation.

The rate of interest accrual varies depending on the type of loan and prevailing interest rates. It’s important to check your loan documents and your loan servicer’s website to determine the specific interest rate on your loans. This information will allow you to accurately project your future debt and make informed decisions about repayment.

Failing to understand interest accrual can lead to unexpected debt upon graduation. By understanding how interest works on your specific student loans, you can better prepare for repayment and potentially save money in the long run.

How to Make Interest-Only Payments Now

Making interest-only payments on your student loans while still in school can be a strategic move to manage your debt and potentially save money in the long run. However, it’s crucial to understand the implications before proceeding.

First, confirm with your loan servicer if interest-only payments are an option for your specific loan type. Not all student loan programs allow this. Contacting them directly is the best way to obtain accurate and personalized information.

Next, determine if it aligns with your financial goals. While interest-only payments reduce your monthly burden, remember that you are only paying the interest; the principal balance remains unchanged. This means you’ll pay more in interest overall and may take longer to pay off your loans. Consider your post-graduation income prospects and ability to manage higher payments.

Once you’ve confirmed eligibility and considered the long-term implications, explore the available payment methods offered by your servicer. This could include online portals, automated payments, or mail-in checks. Select the method most convenient for your circumstances and ensure timely payments to avoid late fees.

Finally, carefully track your payments to ensure accuracy and maintain a clear record. Regularly review your loan statements to monitor your progress and promptly report any discrepancies to your servicer. This diligent approach is crucial for maintaining a healthy financial standing.

The Role of Your Loan Servicer

Your loan servicer is a crucial part of the student loan process. They are the company responsible for managing your student loans after they’re disbursed. This includes receiving your monthly payments, answering your questions, and providing important information about your loan.

Understanding your servicer’s role is essential for successfully navigating your student loan repayment journey. They act as the intermediary between you and the lender (usually the government or a private institution). They’re responsible for processing payments, updating account information, and managing any changes to your loan terms.

Key responsibilities of your loan servicer typically include: processing your payments; providing statements detailing your account balance and payment history; managing your deferment or forbearance requests; responding to your inquiries regarding your loan; and notifying you of important updates concerning your loan status, such as changes to payment plans or interest rates.

Contacting your servicer is important for various reasons, from addressing payment issues to gaining clarity on repayment options. It’s vital to keep your contact information up-to-date with your servicer to ensure you receive important communications. They will be your primary point of contact throughout the life of your student loans.

Note: It is possible to have multiple servicers if you have loans from different lenders. It’s crucial to keep track of each servicer’s contact information and account details separately.

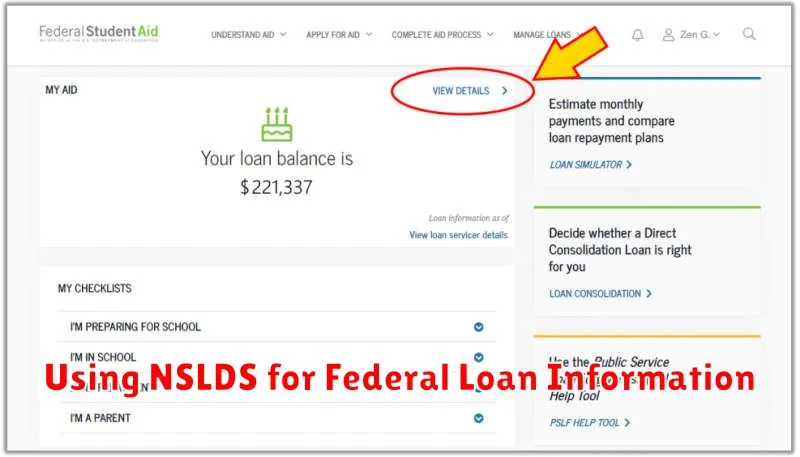

Using NSLDS for Federal Loan Information

The National Student Loan Data System (NSLDS) is a central database that houses information on your federal student loans. It’s a crucial tool for tracking your loan details while you’re still in school, providing a comprehensive overview of your borrowing history.

Accessing NSLDS requires your Federal Student Aid ID (FSA ID), which serves as your electronic signature for accessing federal student aid information. Once logged in, you can view vital information such as your loan servicer, the total amount borrowed, the types of loans you’ve received (such as subsidized or unsubsidized loans), and the current status of your loans (in-school deferment, grace period, repayment, etc.).

NSLDS is particularly helpful in verifying the accuracy of your loan information. It allows you to confirm that the details listed are correct and to identify any discrepancies early on. This proactive approach can help prevent future complications with loan repayment.

While NSLDS provides a consolidated view of your federal student loans, remember that your individual loan servicer will be your primary point of contact for specific questions about your loan repayment plan or other loan-related matters. NSLDS serves as a valuable initial resource for accessing a complete picture of your federal student aid.

Regularly checking your NSLDS account is highly recommended. Staying informed about your student loan details while you are still in school is a crucial step towards responsible financial management after graduation.